![India’s Unicorn Club: Here's The Comprehensive List Of 100+ Unicorns In India]()

In 2013, venture capitalist Aileen Lee personified the term ‘unicorn’ within the startup ecosystem to indicate the rarity of startups with a valuation of over $1 Bn. A decade later, unicorns in India are no longer rare! In May, India became home to 100 unicorns, when neobanking startup Open raised $50 Mn to claim the position of India’s 100th unicorn.

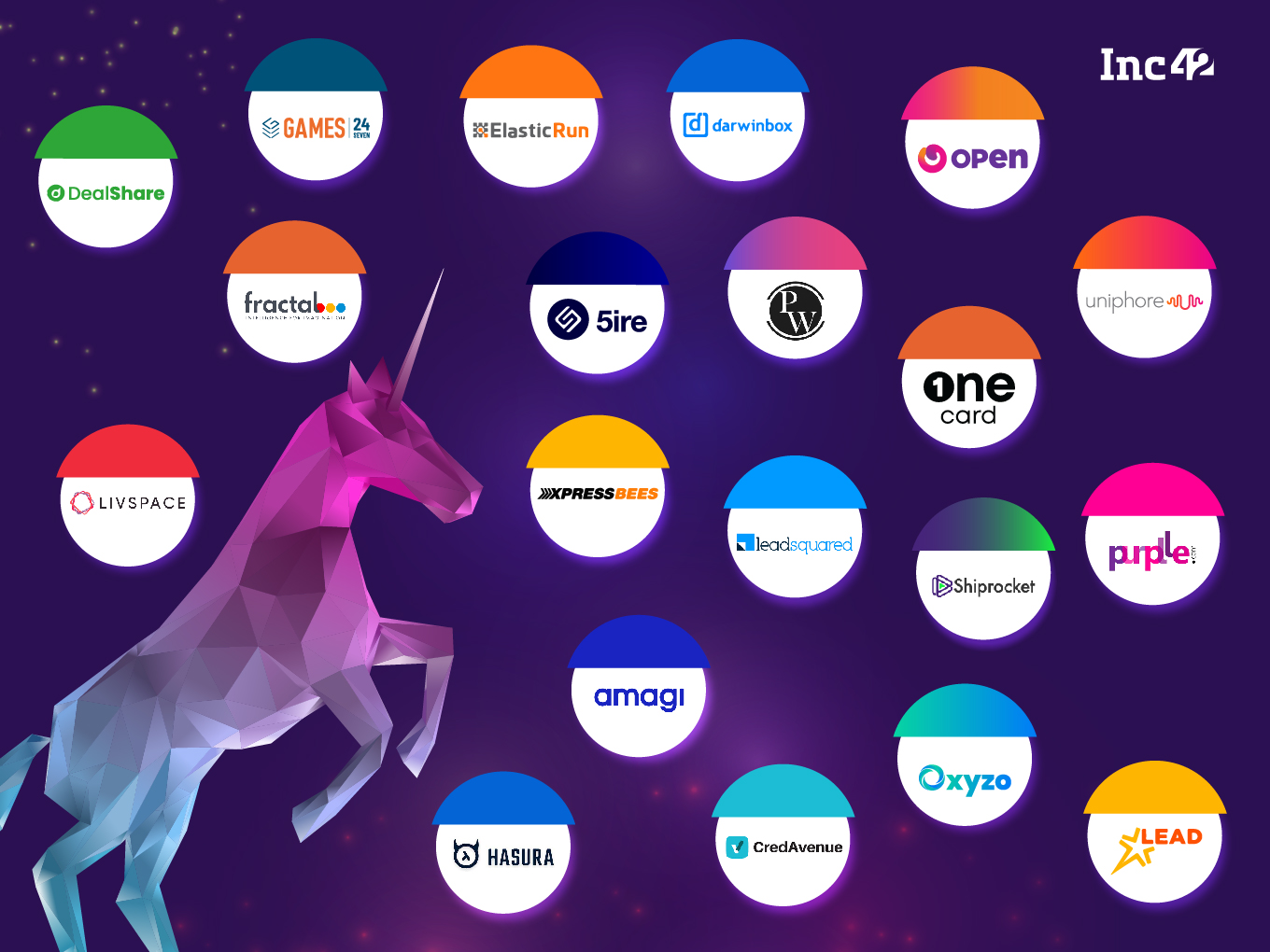

India achieved the milestone shortly after a wild funding year which saw Indian startups raising $42 Bn across 1,583 deals in 2021 and minting 42 unicorns in the process. India ended 2021 with 86 unicorn startups, and at a striking distance from scoring a century of unicorns, according to Inc42’s unicorn tracker.

The march continued in 2022, as India added 20 more unicorns to the club.

From producing its first unicorn in the form of InMobi in 2011 to hitting the century of unicorns in India by 2022, it has been a long and eventful journey for the Indian startup ecosystem. The country is witnessing an unprecedented surge in VC investment and tech entrepreneurship, and the Startup India initiative has played an important role in it.

Since its inception in 2015, a slew of policies, FoF and thematic funds, incubation programs, tax holidays and tax benefit schemes have been announced and launched under the Startup India initiative. With a massive tech transition to digital services and products in place and an active internet subscriber base of over 783 Mn (as of February 2022), India is now ready for the next stage of tech evolution.

While 2021 was the year of record-breaking funding, 2022 has seen India achieve a historic landmark in the first few months with 20 Indian startups entering the unicorn club. The focus should now be on the sustainability of these 100+ unicorns and helping a new set of Indian startups turn unicorns.

However, for that, the government will need to work on removing some of the obstacles like solving structural issues in the economy, preventing migration of Indian startups to cities like Dubai, and improving the ease of doing business, among others, to achieve the plausible target of having 250 unicorns by 2025.

List Of Unicorns In India

Collectively, the 106 Indian unicorns have raised a total of $94 Bn in funding to date and are valued at around $343 Bn combined. We at Inc42 have been tracking the Indian unicorns since 2016.

![Indian Unicorns]()

Here is a list of all the startups in India’s unicorn club:

Unicorns In India: Indian Startups That Entered The Unicorn Club In 2022

Shiprocket

Founded in 2017 by Saahil Goel, Vishesh Khurana, Gautam Kapoor and Akshay Gulati, Shiprocket is a Gurugram-based third-party logistics service provider, backed by the likes of Zomato, Temasek and Bertelsmann. The 3PL player became India’s 106th unicorn in August 2022 when it raised $33.5 Mn in a round led by Lightrock India.

Shiprocket claims to serve the logistics needs of more than 2.5 Lakh sellers across India and ships to more than 70 Mn consumers annually. The company offers logistics services to ecommerce sellers and direct-to-customer (D2C) brands alike, also providing tech-enabled logistics solutions for sellers.

In 2022, Shiprocket has made five acquisitions so far, including one of the biggest-ever acquisitions in the Indian startup ecosystem when it acquired rival 3PL player Pickkr for $200 Mn in June.

5ire

Founded in 2021 by Pratik Gauri and Prateek Dwivedi and Vilma Mattila, 5ire is a 5th generation Layer-1 (L1) blockchain network. The deeptech startup joined India’s unicorn club in July 2022, after raising $100 Mn in a funding round led by UK-based conglomerate SRAM & MRAM at a valuation of $1.5 Bn.

5ire has its own blockchain, called 5irechain, which is based on sustainability and works on a Proof-of-Benefit methodology for consensus. 5ire’s blockchain measures and rewards sustainability using a unique mathematical model. Talking with Inc42, Gauri said that Proof-of-benefit gives scores based on the UN’s 17 sustainable development goals (SDGs) and 650 environmental, social and governance (ESG) parameters.

The newly-minted unicorn will keep India as its core focus and is working with various companies and government agencies across the globe to solve sector-agnostic problems with blockchain.

OneCard

Founded in 2018 by Anurag Sinha, Rupesh Kumar and Vaibhav Hathi, OneCard is a Pune-based fintech startup that offers Visa credit cards. The startup joined the unicorn club, becoming India’s 104th unicorn in July 2022 after it raised $100 Mn in a round led by Temasek. According to Inc42’s calculation, the startup’s valuation reached $1.25 Bn with the latest funding round.

Apart from offering credit cards, OneCard also has its own credit score platform called OneScore, which allows users to check their credit score free of charge. OneCard has disbursed over 2.5 Lakh cards to its customers so far. In FY21, the startup recorded a loss of INR 33.1 Cr, with its revenue standing at INR 16.3 Cr.

OneCard competes with other credit card providers such as slice and Uni Card, among others. The newly-minted unicorn becomes India’s 22nd fintech unicorn.

LeadSquared

Founded in 2011 by Nilesh Patel, Sudhakar Gorti and Prashant Singh, LeadSquared offers CRM, marketing and sales software solutions. The India and US-based startup became India’s 103rd unicorn in June after it raised $153 Mn from WestBridge Capital, taking it to unicorn valuation.

The startup offers products to verticals such as edtech, healthcare, BFSI, real estate, automotive and hospitality. The newly-minted startup has more than 2,000 enterprise clients and 150K mobile users across 40 countries, counting the likes of BYJU’S, Dunzo, Zoomcar and Cars24 among its clientele.

The SaaS unicorn’s cofounder and CEO Nilesh Patel, while talking with Inc42, had said that LeadSquared will go for acquisitions and international expansion with the incoming funds. “The intent is to look at what is there and basically what offers the opportunity to expand faster than the market,” he added.

Purplle

Founded in 2012 by Manish Taneja and Rahul Dash, Purplle is a Mumbai-based ecommerce startup focused on beauty-oriented products and appliances. It became India’s 102nd unicorn after it raised $33 Mn in a Series E funding round, from new and existing investors at a valuation of $1.1 Bn. The ecommerce startup has raised a total of $215 Mn so far.

Purplle features a range of products from both legacy and new-age beauty companies, having more than 1,000 brands and over 60,000 products listed on its platform. The Mumbai-based ecommerce unicorn also claims to have 7 Mn users. It has also created a house of brands with the likes of FACES CANADA, Good Vibes, Carmesi, Purplle, and NY Bae.

It is targeting an annualised GMV rate of $180 Mn in FY22, having recorded a loss of INR 51.27 Cr in FY21, up 110% from INR 24.38 Cr in FY20.

PhysicsWallah (PW)

Started in 2016 as a physics-focused competition prep YouTube channel by Alakh Pandey and Prateek Maheshwari, PhysicsWallah pivoted to being a full-fledged edtech platform in 2020. The startup became India’s 101st unicorn after raising $100 Mn in a Series A round from Westbridge and GSV Ventures, at a valuation of $1.1 Bn.

The edtech platform focuses on competitive exam prep for NEET and IIT/JEE alone, with multiple course offerings on both its YouTube channel, the website and the mobile app. PW, as it is colloquially known, claims that more than 10,000 of its students have cracked NEET and JEE in 2020 and 2021.

PhysicsWallah is also moving towards offline centres, having already opened 20 centres in 18 cities so far. With the recent fundraise, the Noida-based edtech startup will open another 20 centres across the country.

Open

Open, the 100th Indian unicorn, is a neobanking fintech startup founded in 2017 by Anish Achuthan, Ajeesh Achuthan, Mabel Chacko, and Deena Jacob. Open offers business banking, payments, and expense management services to small and midsize businesses (SMBs) across the country.

The startup claims to have increased its customer base to 2.3 Mn in the past 12 months and plans to reach 5 Mn customers globally in the next year. Open processes over $24 Bn annually and claims to add 100K SMEs every month.

The fintech startup counts Temasek, BEENEXT, 3one4 Capital, and Trifecta Capital Advisors among its key investors. It has raised $140 Mn so far.

Open hit the unicorn status in April 2022, becoming the 100th Indian unicorn, by raising $50 Mn at a valuation of $1 Bn.

Games24x7

Founded by Bhavin Pandya and Trivikraman Thampy in 2006, Games24x7 is a gaming startup which houses popular brands such as RummyCircle, an online card game, and sports fantasy game My11 Circle. The third product from the startup is U Games, a hub for casual games.

Games24x7 became the 99th unicorn of India in March when it raised $75 Mn in a funding round led by Malabar India Fund at a valuation of $2.5 Bn. Its existing investor US-based hedge fund Tiger Global also participated in the funding round.

Games24x7’s My11Circle competes with Dream11, MPL, BalleBaazi, and Nazara’s Halaplay, among others. RummyCircle’s competitors include PlayRummy, JungleeRummy, and Adda52Rummy, among others.

Oxyzo

Oxyzo, the financial arm of B2B commerce unicorn OfBusiness, was founded in 2016 by OfBusiness founders Asish Mohapatra and Ruchi Kalra. It is a lending platform that provides cash flow and matched working capital financing for buying new materials for SMEs in the manufacturing and contracting sectors.

The Indian startup claims to have $350 Mn in assets under management (AUM), growing 100% on a year-on-year (YoY) basis. Oxyzo is currently serving 2,500+ SMEs across India, disbursing loans worth INR 4,000 Cr per annum.

It counts the likes of Alpha Wave, Tiger Global, Norwest Venture Partners, Matrix Partners, and Creation Investments among its investors, and has raised only one funding round so far. However, it was the largest Series A funding round in the country. The startup raised $200 Mn in that funding round, turning into a unicorn.

Amagi

Founded in 2008 by Baskar Subramanian, Srinivasan KA, and Srividhya Srinivasan, Amagi offers creation, distribution, and monetisation tools for live, linear, and on-demand channels across cable, OTT, and free ad-supported streaming TV platforms.

The Bengaluru-headquartered cloud-based media Saas technology startup turned unicorn earlier this year after raising $95 Mn in a funding round led by Accel. Recently, it also announced the enhanced version of its live orchestration platform, Amagi LIVE.

CredAvenue

Continuing the momentum from 2021, debt marketplace CredAvenue joined the unicorn club in March 2022. CredAvenue entered the unicorn club with $137 Mn funding from Insight Partners, B Capital, and Dragoneer Investment Group, among others.

At the time of the fundraise, the startup said that it intended to use the funds to expand the business in India along with key global markets, organically and inorganically, by acquiring diverse companies for forward and backward services and products integration.

Founded by Gaurav Kumar in 2017, CredAvenue is a debt platform that connects enterprises with lenders and investors.

Its offerings include CredLoan, CredCoLend, Plutus, CredSCF and CredPool. It claims to have more than 2.3K corporates and over 750 lenders in its portfolio.

It recently acquired an 82% stake in SaaS startup Corpository through a combination of primary investment and secondary purchase from existing shareholders. In February 2022, the startup acquired about 75% stake in digital collections startup Spocto.

Hasura

Founded in 2018 by Tanmai Gopal and Rajoshi Ghosh, Hasura provides data access and data flow tools and services via GraphQL APIs, a solution to accelerate product and data delivery. The company’s technology automatically creates real-time GraphQL APIs, granting customers instant access to their data via secure APIs.

Hasura entered the unicorn club early this year after raising $100 Mn led by Greenoaks Capital. The Series C funding round also saw participation from existing investors such as Nexus Venture Partners, Lightspeed Venture Partners, and Vertex Ventures.

The Series C round came almost after two years of its Series B round. The Indian startup had raised $25 Mn from Lightspeed Venture Partners in participation with Vertex Ventures, and Nexus Ventures, among others, in its Series B round.

Uniphore

Conversational automation startup Uniphore became the eighth unicorn of 2022 after raising a record $400 Mn in funding at a valuation of $2.5 Bn.

Founded by Ravi Saraogi and Umesh Sachdev in 2008, Uniphore is a conversational automation platform that combines conversational AI, workflow automation, and RPA (Robotic Process Automation) in a single integrated platform to transform and democratise customer experience across industries.

The startup is backed by marquee investors like Sorenson Capital Partners, Serena Capital, Cisco Investments, Iron Pillar, and Chiratae Ventures, among others.

Checkout The Indian Unicorn Tracker

Xpressbees

Logistics startup Xpreesbees was one of the early entrants to the unicorn club this year. The startup, which began its operations under Supam Maheswari’s FirstCry, later spun off to operate independently in 2015. The logistics startup claims to have operations across 3,000 cities and delivers across 20,000 pin codes.

The startup bagged $300 Mn in its Series F round led by Blackstone Growth, TPG Growth, and Chrys Capital to cross the $1 Bn valuation mark. Currently, the startup has 100 hubs with over 10 lakh sq ft warehousing capacity.

![Here Are The 20 Indian Startups That Entered The Unicorn Club In 2022]()

Livspace

Founded in 2014 by Anuj Srivastava and Ramakant Sharma, Livspace is a curated marketplace that provides an end-to-end home design experience. The startup’s online marketplace also offers software tools that can help designers and homeowners design interiors.

It is present across nine metro cities and claims to have served about 20,000 customers. In India, Livspace competes with Bengaluru-based Homelane and other players in a largely unorganised market for home redesigns, interior design and custom furniture.

The startup hit the unicorn valuation in February 2022, raising $180 Mn in a funding round.

In total, it has raised upwards of $431 Mn through various funding rounds from investors such as Kohlberg Kravis Roberts, Trifecta Capital, and Tahoe Investment Group.

ElasticRun

Founded in 2016 by Sandeep Deshmukh, Saurabh Nigam and Shitiz Bansal, ElasticRun’s tech platform acts as an extended arm of FMCG companies’ direct distribution networks in rural areas and enables these businesses to reach small ’Kirana’ stores in the hinterland. The startup also engages with banks and financial institutions to give them access to underserved SME customers from its Kirana network.

The Pune-based commerce startup entered the unicorn club in February after it raised $300 Mn in a funding round led by Masayoshi Son’s SoftBank. It also saw the participation of New York-based Goldman Sachs, Prosus Ventures (earlier known as Naspers Ventures), Innoven Capital, and Abu Dhabi’s Chimera Investment, a subsidiary of Abu Dhabi’s Royal Group.

DealShare

Founded in September 2018 by Vineet Rao, Sourjyendu Medda, Sankar Bora and Rajat Shikhar, DealShare is a social ecommerce marketplace. It enables first-time internet users to shop online.

The startup sells grocery and household essential products through social media and messenger platforms like WhatsApp. DealShare competes with the likes of social commerce unicorn Meesho, BulBul, YouTube’s SimSim, and GlowRoad, among others.

At the beginning of 2022, the Bengaluru-based social commerce startup raised $165 million from investors led by Tiger Global and Alpha Wave Global to become the fifth Indian unicorn of 2022.

Darwinbox

Founded in 2015 by Chaitanya Peddi, Jayant Paleti and Rohit Chennamaneni, Darwinbox is a cloud-based HRtech startup that caters to companies’ HR needs across recruitment, onboarding, core transactions (leaves, attendance, directory), payroll, travel and people analytics, among others.

Darwinbox raised $72 Mn in a funding round led by Technology Crossover Ventures. With this capital infusion, the startup’s valuation crossed the $1 Bn mark, making it the third Indian unicorn minted in 2022.

Existing investors Salesforce Ventures, Sequoia India, Lightspeed India, Endiya Partners, 3One4Capital, JGDEV and SCB 10X also participated in the round.

LEAD

Founded in 2012 by Sumeet Mehta and Smita Deorah, LEAD is a Mumbai-based edtech startup focusing on enabling better school education using technology.

LEAD offers a range of services, including full-stack school edtech solutions targeting students, especially in non-metro cities. The startup aims to reach 25 Mn students in 60,000 schools by the end of 2026. According to the startup, it will be entering the 2022-23 academic year with more than 5,000 schools from across 500 Indian cities on board, serving more than 2 Mn students.

LEAD became the first Indian startup to hit unicorn valuation in 2022 when it raised $100 Mn at a valuation of $1.1 bn. The edtech startup is backed by WestBridge Capital, Elevar Equity and GSV Ventures, among others. It has raised $166 Mn across various funding rounds.

Fractal

Fractal Analytics was founded in 2000 by a five-member team including IIM Ahmedabad alumni Srikanth Velamakanni and Pranay Agrawal, along with Nirmal Palaparthi, Pradeep Suryanarayan, and Ramakrishna Reddy.

Fractal provides artificial intelligence and advanced analytics solutions. The AI and advanced analytics solutions startup employ people across 16 locations globally, including India, the US, the UK, and Singapore, among others.

The Mumbai and New York-based startup offers several products such as Qure.ai which assists radiologists, Crux Intelligence to assist CEOs and senior executives, and Theremin.ai to improve investment decisions, among others.

Velamakanni-led Fractal entered the growing unicorn list in January 2022 with an investment of $360 million from the private equity firm TPG Capital Asia. Although it became the second unicorn of 2022 following MamaEarth, it had to wait for two decades for it.

Unicorns In India: Indian Startups That Entered The Unicorn Club In 2021

Acko Insurance

Insurance provider Acko entered the coveted unicorn club in 2021 after it raised $255 million in its series D funding round led by private equity firms General Atlantic and Multiples Private Equity. The Mumbai-based unicorn has raised around $428 Mn to date. Founded in 2016 by Varun Dua and Ruchi Deepak, Acko offers auto insurance and covers workers through partnerships with companies, including Zomato and Swiggy.

Acko counts Amazon, Accel Partners, Catamaran Ventures, Elevation Capital, RPS Ventures, and Binny Bansal, among others, as its investors. The startup has also introduced a health insurance policy for consumers between the ages of 18 to 45 years as part of its strategy to enter the retail health insurance space.

Apna

Founded in 2019 by Nirmit Parikh, Apna provides a job marketplace for India’s blue-collar workers and skilled professionals such as painters, carpenters, and sales agents, among others. It entered the celebrated unicorn club in 2021, within two years of its inception, when it raised $100 Mn in a Series C round led by Tiger Global at a valuation of $1.1 Bn.

During the fundraise, the startup claimed it had over 16 Mn job seekers on its platform and that it helped 150K employers hire talent.

Zomato, Urban Company, PhonePe, BurgerKing, edtech giant BYJU’S and Bharti AXA are among the clients served by Apna. The startup recently launched its first brand campaign to reach job aspirants pan India.

Checkout The Indian Unicorn Tracker

BharatPe

From boardroom battles to social media spats, Indian startup BharatPe has been the talk of the town in the last couple of months. The controversies around the startup started with an infamous audio recording which gradually culminated in the resignation of BharatPe cofounder Ashneer Grover.

In sharp contrast to the current situation, the fintech startup was celebrated for all good reasons last year. It entered the unicorn club after raising $370 Mn in a Series E equity round, led by Tiger Global, at a valuation of $2.85 Bn.

Founded in 2018 by Ashneer Grover and Shashvat Nakrani, BharatPe launched India’s first UPI interoperable QR code. It is primarily a merchant-focused payments platform that offers a single interface for all existing UPI apps and other payment systems. It has also diversified into lending and other verticals.

Blackbuck

Founded in 2015 by Rajesh Yabaji, Chanakya Hridaya, and Rama Subramaniam, Blackbuck connects businesses with truck owners and freight operators. The Bengaluru-based logistics startup lists truck services on its platform and does an intelligent match for customers, based on their requirements.

It entered the unicorn club in 2021 after raising $67 Mn in its Series E round. The startup claims to have over 15,000 clients, 12,00,000 + trucks. Blackbuck also has a presence in Europe.

Blinkit (Grofers)

Grofers, now rebranded as Blinkit, was founded in 2013 by Saurabh Kumar and Albinder Dhindsa. After witnessing several ups and downs, the startup entered the unicorn club last year following an investment from Zomato. The foodtech giant acquired a 9.16% stake in the online e-grocery firm for INR 518.2 Cr, which valued the startup at around $1 Bn.

Grofers initially started as an on-demand pick-up and drop-off service, and later forayed into the grocery business. After Zomato invested in it last year, Grofers rebranded itself as Blinkit to focus on quick commerce.

“We learnt a lot as Grofers, and all our learnings, our team, and our infrastructure is being repurposed to pivot to something with staggering product-market fit – quick commerce. Today, we are surging ahead as a new company, and we have a new mission statement – “instant commerce indistinguishable from magic”. And we will no longer be doing this as Grofers – we will be doing it as Blinkit,” Dhindsa said in a blog post.

Blinkit is also now all set to merge with Zomato in a share-swap deal. Zomato also approved a $150 Mn loan to Blikit’s parent company, Grofers India, in March. As part of the deal, the loan will be disbursed to Grofers in one or more tranches.

Browserstack

Founded in 2011 by Ritesh Arora and Nakul Aggarwal, Browserstack is a software and mobile app testing cloud platform. The homegrown software-as-a-service (SaaS) startup joined the unicorn club after it raised $200 Mn in a Series B funding round. The company claims that its platform is used by 4 Mn developers spread across 50,000 companies, including tech giants such as Google, Microsoft and Twitter.

The startup has been profitable since day one and has been a market leader since its early days. Earlier this year, BrowserStack announced the launch of BrowserStack Champions, a community program to bring together the thought leaders of software testing and development.

CarDekho

CarDekho is an Indian search and ecommerce platform for new and used cars. It also has an insurance vertical. Founded in 2007 by Amit Jain and Anurag Jain, CarDekho claims to have tie-ups with many auto manufacturers, more than 4,000 car dealers and numerous financial institutions to facilitate the purchase of vehicles.

The automobile marketplace turned unicorn in October 2021 after its parent CarDekho Group (also known as GirnarSoft) secured $250 Mn in its Series E financing round. The round was led by Leapfrog Investments alongside Canyon Partners, Mirae Asset, Harbor Spring Capital and existing investors Sequoia Capital India and Sunley House.

At the time of fundraising, Amit Jain, cofounder and chief executive of CarDekho, said that the startup was planning its initial public offering in the next 18 months. GirnarSoft’s revenue from operations stood at INR 884.3 Cr during the financial year ended March 31, 2021.

Chargebee

Founded in 2011 by Krish Subramanian, Rajaraman Santhanam, Saravanan KP and Thiyagarajan T, Chargebee is a revenue management platform that automates revenue operations of over 4,000 high-growth subscription-based businesses.

The Chennai-based startup entered the unicorn club with its $125 Mn Series G Round in 2021. This year, the startup doubled its valuation to $3.5 Bn after a $250 Mn funding round led by major VC funds like Tiger Global and Sequoia Capital.

To date, Chargebee has raised total funding of $470 Mn. Its customer portfolio includes the likes of access management companies Okta, Freshworks, Calendly, and Study.com, among others.

CoinDCX

Founded in 2018 by Sumit Gupta and Neeraj Khandelwal, CoinDCX became the first Indian cryptocurrency exchange to reach unicorn status last year. The crypto exchange closed a $90 Mn Series C funding round in August 2021, led by Facebook cofounder Eduardo Saverin’s B Capital Group as well as Coinbase Ventures, Polychain Capital, Block.one, Jump Capital among others, to reach the unicorn status.

Recently, CoinDCX became India’s most valued crypto startup after it raised more than $135 Mn in a Series D funding round.

With this fundraise, the startup’s valuation soared to $2.15 Bn. It also runs CoinDCX Go, a crypto investment app; CoinDCX Pro, a professional trading platform; and DCX Learn, a crypto-centric investor education platform.

CoinSwitch Kuber

Founded in 2017 by Ashish Singhal, Govind Soni and Vimal Sagar Tiwari as a global aggregator of cryptocurrency exchanges, CoinSwitch launched its India exclusive crypto platform, CoinSwitch Kuber, in June 2020 to simplify crypto investments for Indian retail investors.

Last year, it became the second crypto unicorn when it raised $260 Mn at a valuation of $1.9 Bn in its Series C funding round led by Coinbase Ventures and Andreessen Horowitz (a16z).

The Bengaluru-based crypto startup recently completed its first-ever employee stock ownership buyback plan (ESOP) worth $2.5 Mn.

CRED

Founded in 2018 by Kunal Shah, CRED offers premium credit card users rewards and benefits for paying credit card bills. It has also been working on ancillary services built around its primary ecosystem of credit card-centric services. The startup entered into P2P lending late last year.

In April 2021, the Bengaluru-based fintech startup raised $215 Mn in Series D funding, at a post-money valuation of $2.2 Bn to turn unicorn. Later in the year, the startup raised $251 Mn in its Series E round, co-led by Tiger Global and Falcon Edge, at a valuation of $4 Bn.

Recently, CRED allotted a total of 6,048 equity shares to around 125 employees upon ESOP conversion. The fintech startup is also reportedly in talks to raise another funding round which is likely to further soar its valuation from $4 Bn to around $6 Bn.

Cure.Fit

Founded in 2016 by Mukesh Bansal and Ankit Nagori, CureFit uses an online-offline model to offer physical fitness (Cult.fit), mental fitness (Mind.fit), and nutrition (Eat.fit). It also has a primary care vertical (Care.fit).

CureFit entered the unicorn club late last year after foodtech giant Zomato invested in the startup. Zomato sold its fitness facility arm Fitso to CureFit for $50 Mn and invested another $50 Mn in the health and wellness startup. In the cross-selling, Zomato acquired a total shareholding of 6.4% worth $100 Mn in CureFit.

“This will help us potentially explore cross-selling benefits between Zomato and CureFit, as we see food and health becoming the same side of the coin in the long term,” Zomato founder Deepinder Goyal had said in a blog post then.

Soon after it became a unicorn, CureFit acquired at-home cardio equipment brands RPM fitness, Fitkit, Onefitplus, and Urban Terrain in a single transaction. However, the Zomato-backed fitness startup saw its sales revenue decline 67.4% in the financial year ending March 31, 2021. It posted total revenue of INR 294.9 Cr in FY21, as compared to INR 567.4 Cr in FY20.

Digit Insurance

Bengaluru-based insurtech startup Digit Insurance was the first unicorn of 2021. The startup raised $18 Mn from existing investors A91 PArtners, Faering Capital and TVS Capital in January 2021 at a valuation of $1.9 Bn.

Founded in 2016 by Kamesh Goyal and Prem Watsa’s Fairfax Holdings, Digit Insurance is a tech-driven general insurance company. The company offers customised policies on health, auto, travel, smartphones, and commercial properties such as stores and holiday homes.

Digit Insurance recently said it crossed the INR 5,000 cr yearly revenue milestone in FY22. Its gross written premiums stood at INR 5,268 crore during the year.

Droom

Founded in 2014 by Sandeep Agarwal, Droom provides an online platform where users can buy and sell used and new automobiles in India and other emerging markets. Droom has four marketplace formats — B2C, C2C, C2B, and B2B, and three pricing formats — fixed price, best offer and auction.

The Indian startup entered the unicorn club after a pre-IPO round of $200 Mn in July 2021. Existing and new investors, such as 57 Stars and Seven Train Ventures, participated in the round.

Later in the year, the auto marketplace converted itself into a public company. It is likely to launch its INR 3,000 Cr initial public offering (IPO) in the next two months.

EaseMyTrip

Founded in 2008 by Nishant Pitti, Rikant Pitti and Prashant Pitti, EaseMyTrip allows its customers to book air, rail and bus tickets, hotel and holiday packages, and also offers other travel services. In the Indian market, EaseMyTrip competes with Yatra, MakeMyTrip, ixigo, and Cleartrip, among others.

The Delhi-based traveltech startup was bootstrapped until its public listing in March 2021. Later in the year, it hit a market capitalisation of $1 Bn on September 17, soon after it announced its international foray into the US, the Philippines and Thailand markets.

The company also has a presence in the UAE, Singapore, and the UK. It is also planning to foray into currency exchange service for which it will be applying for a licence to the Reserve Bank of India, as per a PTI report.

![Here Are The 41 Indian Startups That Entered The Unicorn Club In 2021]()

Eruditus

After the pandemic accelerated the growth of the edtech industry in India, Mumbai-based Eruditus became India’s fourth edtech startup to join the unicorn club. It raised $650 Mn in a funding round led by Accel US and Masayoshi Son-led SoftBank Vision Fund II in 2021, which increased its valuation to $3.2 Bn from $800 Mn in 2020.

Founded in 2010 by Chaitanya Kalipatnapu and Ashwin Damera, Eruditus offers executive education programmes in association with global business schools such as MIT, Columbia, Harvard Business School, INSEAD, Tuck at Dartmouth, Wharton, UC Berkeley and London Business School.

The startup also offers courses from Indian institutions such as IIT Kozhikode, IIM Lucknow, and BML Munjal University among others. It is also backed by Bertelsmann India Investments, Chan Zuckerberg Initiative (CZI), a non-profit organisation headed by Facebook CEO Mark Zuckerberg and his wife Priscilla Chan.

GlobalBees

Thrasio-style startup GlobalBees joined the unicorn club in December 2021. It raised close to $111.5 Mn in a mix of equity and debt in a Series B round of investment led by FirstCry. The round also saw participation from SoftBank, Premji Invest, Chiratae Ventures, and Trifecta Capital, among others. The funding round valued GlobalBees at $1.1 Bn.

Launched in 2021, GlobalBees, which is headed by Nitin Agarwal as the CEO, invests in and acquires seller businesses on Amazon India, Flipkart and other ecommerce marketplaces.

Recently, Inc42 reported that GlobalBees would make its foray into the consumer electronics segment with an investment in D2C appliance brand Candes. In an extraordinary general meeting on April 18, the shareholders of Candes decided to allot 17,544 compulsorily convertible preference shares (CCPS) to GlobalBees.

Good Glamm Group

Founded in 2015 as MyGlamm, The Good Glamm Group turned a unicorn last year after it raised $150 million in a Series D funding round led by Prosus Ventures (Naspers) and Warburg Pincus. Darpan Sanghvi, founder and CEO of The Good Glamm Group, built the direct-to-consumer makeup brand MyGlamm.

Last year, MyGlamm announced the formation of The Good Glamm Group to consolidate its position as a ‘Digital House of Brands’ powered by a content-to-commerce strategy. The Good Glamm Group runs multiple brands, including MyGlamm, MomsCo, POPxo and Baby Chakra, Plixxo, ScoopWhoop, among others.

Continuing its acquisition spree, it acquired a majority stake in beauty and personal care brand Organic Harvest in February 2022 for an undisclosed amount.

Checkout The Indian Unicorn Tracker

Groww

Founded in 2017 by ex-Flipkart employees Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, Groww offers direct plans for mutual funds and investing via mobile application and web platform. It also allows users to invest in stocks, mutual funds, ETFs, IPOs, and gold.

Talking about the inspiration behind starting Groww, Keshre recently said that he and other cofounders of the startup felt that financial products and services in India were more commission-centric than customer-centric. “We wanted to build a Flipkart for financial services,” Groww’s Lalit said at The Makers Summit 2022.

Groww raised $83 Mn in its Series D funding, led by Tiger Global, to enter the unicorn club. The round also saw participation from existing investors Sequoia India, Ribbit Capital, YC Continuity and Propel Venture Partners. Later in the year, Groww also raised $251 Mn in its Series E round, which valued the Indian startup at $3 Bn.

Gupshup

Founded by Beerud Sheth in 2004, Gupshup is a conversational messaging platform that caters to businesses from multiple sectors, including banking, ecommerce, hospitality, and consumer goods, among others. Along with India, it also has presence in the US and Latin America. Some of its clients include Kotak Mahindra Bank, IndusInd Bank, HDFC Bank, Ola, Zomato, and Flipkart.

San Francisco-headquartered Gupshup entered the unicorn club in 2021 after raising $100 Mn in its Series F funding round led by Tiger Global Management.

The enterprisetech unicorn recently acquired a 100% stake in conversational AI provider AskSid in an all-cash deal to strengthen its customer experience offerings. In the last few months, Gupshup acquired Dotgo, Knowlarity, and Active.Ai.

Infra.Market

Founded in 2016 by Aaditya Sharda and Souvik Sengupta, Infra.Market is a B2B online procurement marketplace for real estate and construction material. The platform aggregates demand and matches it with the supply chain, with wholesale pricing on materials, along with affordable credit or financing.

The company’s platform connects its clients directly to its supply chain infrastructure for the ease of ordering, tracking and manufacturing till on-site delivery.

Infra.Market hit unicorn valuation in 2021 after it raised $100 Mn in a Series C funding round. It has backing of Accel, Tiger Global, InnoVen Capital, and Nexus Venture Partners, among others. The B2B startup has raised $376 Mn to date across various funding rounds.

Innovaccer

Founded in 2014 by Kanav Hasija, Abhinav Shashank and Sandeep Gupta, Innovaccer is a healthtech SaaS startup based out of Delhi-NCR. Innovaccer unifies previously siloed data and helps healthcare providers achieve better care quality at a lower cost. It further allows its customers and partners to develop interoperable applications to improve patient outcomes.

The Innovaccer Health Cloud software is used by more than 50 healthcare organisations. Currently, the platform is being used to maintain medical records of over 24 Mn patients. It claims to generate savings of more than $600 Mn for institutions and healthcare providers in the US.

Innovaccer hit unicorn valuation in 2021, it was the first healthtech unicorn in India, after raising $105 Mn in a Series D round. Shortly thereafter, the company raised another $150 Mn, taking its valuation to $3.2 Bn.

Licious

Founded in 2015 by Vivek Gupta and Abhay Hanjura, Licious is a D2C foodtech brand focused on cold-chain food deliveries, including meat. Licious functions on the farm to fork business model, meaning that the company owns the entire back-end supply chain.

In the fresh meat category, Licious specialises in chicken, goat, and lamb products, among others. Besides this, the company also offers a range of fish and seafood products, along with exotic meat varieties like turkey, blue crab, quail and Atlantic salmon.

The D2C startup became a unicorn in 2021, when it raised $52 Mn in its Series G round led by IIFL AMC’s Late Stage Tech Fund. The company is backed by IIFL, along with 3one4 Capital, Bertelsmann India Investments, Mayfield Fund, Nichirin, Temasek Holdings and Vertex. It has raised $488 Mn in funding so far.

Mamaearth

Founded in 2016 by Ghazal and Varun Alagh, Mamaearth initially started by selling baby care products but gradually moved on to become a complete personal care brand.

The startup’s offering consists of a wide range of products, including hair, face and body products, among others. The startup claims that its products are dermatologically tested and FDA approved. It also claims that the products are ‘Made Safe’ certified.

Mamaearth enjoys the backing of marquee investors like Sequoia India, Stellaris Ventures, Fireside Ventures, Marico’s Rishabh Mariwala, Snapdeal founders Kunal Bahl and Rohit Bansal, and Shilpa Shetty Kundra, among others. It has raised $111 Mn so far across various funding rounds. It crossed the $1 Bn valuation mark in December 2021, raising $38 Mn from Sequoia.

MapmyIndia

Founded in 1995 by Rakesh Verma, MapmyIndia is a digital mapping startup that offers geospatial data services to other companies, along with rivaling Google Maps and Apple Maps for mapping in the country.

With over 2,000 customers (as of September 2021) including the likes of Apple, Uber, Amazon, BMW, Honda, Toyota, Mercedes, Ola, Yulu, Flipkart, HDFC Bank as well as public sector entities such as the Central Board of Direct Taxes (CBDT), UMANG e-governance app, ISRO, and others.

MapmyIndia has been profitable for several fiscals now, and it was listed in December 2021, becoming the third profitable tech startup to make a public markets debut, following beauty marketplace Nykaa, and used car marketplace CarTrade.

It charted the unicorn territory with its IPO itself, hitting a market cap of more than $1 Bn with the initial listing. At business close on 9th May, its market cap hovers ever so slightly below the market value.

Meesho

Founded by Aatrey and Sanjeev Barnwal in 2015, Meesho is an online reseller network for individuals and small and medium businesses (SMBs), who sell products within their network on social channels such as WhatsApp, Facebook, and Instagram. It has about 13 Mn individual entrepreneurs, bringing the ecommerce benefits to 45 Mn customers pan India.

Meesho counts B Capital Group, DST Partners, Elevation Capital, Facebook, Fidelity Management And Research Company, Investopad, Prosus & Naspers, Raju Garg, RPS Ventures, Sequoia Capital India, Shunwei Capital, SoftBank Vision Fund, Venture Highway, and Y Combinator among its investors. It has raised upwards of $1 Bn through various funding rounds.

The startup became India’s first social commerce unicorn in India after it raised $300 Mn in a funding round.

Mensa Brands

Founded in May 2021 by Ananth Narayanan, Mensa Brands is a Thrasio model-based rollup ecommerce unicorn.

Mensa Brands’ current portfolio includes Pune-based women’s apparel brand Karagiri, Delhi NCR-based jewellery brand Priyaasi, men’s casualwear brand Hubberholme, Mumbai-based men’s casual wear brand Dennis Lingo, women ethnic wear brand Ishin, smart FMCD startup Helea, Jaipur-based ethnic wear brand Anubhutee, Ahmedabad-based men’s care brand Villain, among others. It claims that the majority of these brands are growing at 100% YoY.

Mensa Brands achieved a $1 Bn valuation after raising $135 Mn in its Series B round led by Alpha Wave Ventures and Falcon Edge Capital. With this, the startup became the fastest to reach unicorn valuation in India, within just 6 months. The startup counts Accel, Alpha Wave Incubation, Alteria Capital, Falcon Edge Capital, InnoVen Capital, and Norwest Venture Partners among its investors, and has raised $218 Mn so far.

Mindtickle

Founded in 2011 by Krishna Depura, Deepak Diwakar, and Nishant Mungali, Mindtickle is a Pune-based sales enablement platform that focuses on improving the sales function in businesses by understanding ideal sales behaviours, increasing seller knowledge and skillsets, and incorporating real-world feedback from their meetings with customers.

The Pune and San Francisco-based company claims to cut training time for salespeople who need to be kept up-to-date on new product lines. It also offers solutions for onboarding, micro-learning, skills development and coaching to companies that have been using legacy learning management systems (LMS).

Mindtickle counts Canaan Partners, New Enterprise Associates, Norwest Venture Partners, and SoftBank Vision Fund among its investors. It has raised more than $281 Mn across various funding rounds. It hit unicorn valuation in August 2021 when it raised $100 Mn in its Series E round of funding.

MobiKwik

Founded in 2009 by the husband-wife duo of Bipin Preet Singh and Upasana Taku, the fintech startup offers multiple financial services. It started its journey as a digital wallet and then pivoted into a horizontal fintech platform that offers multiple financial services, including credit, insurance, and gold loans, among others.

MobiKwik joined the $1 Bn club in October 2021 after a few of its employees exercised employee stock option plans (ESOPs).

Sequoia Capital India, Abu Dhabi Investment Authority, Hindustan Media Venture, and Bajaj Finserv Limited are among its key investors. The fintech unicorn has raised $202 Mn across various funding rounds.

MobiKwik plans to go for an initial public offering (IPO) to raise INR 1,900 Cr at a valuation of $1.5 Bn–$1.7 Bn. However, so far, it has not made any move for it owing to market volatility following the ongoing Russian invasion of Ukraine.

Mobile Premier League

Founded in 2018 by Shubh Malhotra and Sai Srinivas Kiran G, Mobile Premier League, also known as MPL, is an esports gaming startup which offers various gaming options from skill-based games like daily fantasy sports and chess to casual games such as 8 Ball Pool and Fruit Ninja.

MPL claims to have 85 Mn users in India, the US, and Indonesia. Over the years, the startup has partnered with several game developers and added over 70 games to its platform. Sequoia Capital India and Times Internet are among its key investors. MPL has raised more than $376 Mn from its key investors.

The gaming startup hit unicorn valuation in 2021 when it raised around $150 Mn from Legatum Capital, Accrete Capital and Gaingels LLC at a pre-money valuation of $2.3 Bn.

Moglix

Founded in 2015, Moglix is an ecommerce marketplace for different kinds of industrial tools such as power tools, hand tools, adhesives, safety and security, and electricals. It procures and supplies safety tools, hardware, office supplies and more. Moglix runs a supply chain network of 16,000+ suppliers and more than 35 warehouses and logistics infrastructure.

The company serves over 500K small and medium businesses (SMB) and big enterprises including Hero MotoCorp, Vedanta, Tata Steel, Unilever and Air India. It has also set up 3,000 manufacturing plants across India, Singapore, UK and UAE.

The Delhi-NCR-based B2B startup has 13 key investors, which include the likes of Accel, Tiger Global Management, Sequoia Capital India and Ratan Tata, among others. Moglix has raised $622 Mn across various funding deals, hitting the unicorn valuation in 2021 when it raised a $120 Mn funding round in May.

Recently, it crossed $2.6 Bn in valuation, which saw its early investors making as much as 80X returns.

NoBroker

Founded in 2014 by Akhil Gupta, Amit Agarwal, and Saurabh Garg, NoBroker is a Bengaluru-based real estate platform. It provides verified listings from property owners, without any brokerage fees for middlemen. The startup also has the NoBroker Financial Service platform which provides home loans, and the NoBroker Home Services platform which provides packers and movers and legal documentation, among other services.

The company recently launched a tech-enabled security management system called NoBrokerHood that aims to simplify visitor management within residential accommodations and also offers a seller’s marketplace for verified users.

NoBroker counts Elevation Capital, General Atlantic, and Tiger Global Management among its nine key investors. The proptech startup hit unicorn valuation in 2021, after raising $210 Mn in a Series E funding round led by General Atlantic and Tiger Global.

OfBusiness

Founded in 2015 by Asish Mohapatra, Ruchi Kalra, and Bhuvan Gupta, with Nitin Jain, and Vasant Sridhar joining as cofounders, later on, OfBusiness is primarily a B2B ecommerce marketplace. It also offers working capital financing for the procurement of raw materials to small and medium enterprises (SMEs) in the manufacturing and infrastructure space. Its value-added services also include integrated SaaS products.

“Our businesses have grown 3x over the last year just on the impact of the sheer economic recovery we are seeing,” Sridhar had said while speaking at Inc42’s The Makers Summit 2022. He also added that OfBusiness’ lending segment and commerce business saw 2x and 4x growth, respectively, in the same period.

Kotak Mahindra Bank, Norwest Venture Partners, SoftBank Vision Fund, and Tiger Global Management are among the key investors in the B2B marketplace. It is valued at $5 Bn currently and has raised almost $900 Mn in funding across multiple rounds.

OfBusiness became a unicorn in 2021, six years after its incorporation when it raised $160 Mn in a funding round led by SoftBank.

PharmEasy

Founded in 2015 by Dharmil Sheth, Dr Dhaval Shah, and Mikhil Innani, PharmEasy is a healthtech startup that offers an online pharmacy on its platform. The company caters to the chronic care segment and offers a range of services such as teleconsultation, medicine deliveries, and sample collections for diagnostic tests. Post its merger with Medlife, the resulting entity was named API Holdings.

PharmEasy claims to have partnered with over 60K+ brick-and-mortar pharmacies across India and has reportedly served over 20 Mn patients since its inception.

The epharmacy became a unicorn in 2021 after its parent API Holdings raised $323 Mn in a Series E funding round at a valuation of $1.5 Bn. Since its incorporation, PharmEasy has raised $1 Bn in funding across various rounds from marquee investors, such as Prosus Ventures, TPG, Amansa Capital, and Blackstone-backed hedge fund ApaH Capital, among others.

Pristyn Care

Founded in 2018 by Harsimarbir Singh, Vaibhav Kapoor, and Garima Sawhney, Pristyn Care is a Gurugram-based healthtech startup. Pristyn offers affordable advanced surgical care to patients through innovative surgical techniques and recovery measures.

The startup has partnerships with over 700 hospitals in more than 40 cities to provide surgeries and treatments for proctology, urology, ENT, gynaecology, and vascular, among others. Pristyn Care claims that it has more than 300 full-time doctors and has performed more than 45,000 surgeries so far.

Pristyn hit unicorn valuation in 2021 after it raised $96 Mn in a funding round, four months after raising $53 Mn. The unicorn counts Epiq Capital, Hummingbird Ventures, Sequoia Capital, and Tiger Global among its backers. It has raised $164 Mn in various funding rounds.

Checkout The Indian Unicorn Tracker

Rebel Foods

Founded in 2011 by Jaydeep Barman and Kallol Banerjee, Rebel Foods is a Mumbai-based foodtech startup. Its house of brands includes Faasos, Behrouz Biryani, Ovenstory Pizza, Mandarin Oak, The Good Bowl, SLAY Coffee, Sweet Truth, Wendy’s, among others.

With more than 450 kitchens across 70+ cities, Rebel Foods has developed its full-stack technology – Rebel OS – through which, it claims, multiple brands are launched and scaled up in a short period. It is eyeing an IPO in the next 18-24 months.

The foodtech startup hit unicorn valuation in 2021 after raising $175 Mn in a Series F funding round. It is backed by Alteria Capital, Goldman Sachs, InnoVen Capital, Lightbox, Qatar Investment Authority, Sequoia Capital, Sequoia Capital India, and Sistema Asia Capital. Rebel Foods has raised upwards of $500 Mn in its various funding rounds.

ShareChat

Founded in 2015 by Ankush Sachdeva, Bhanu Singh and Farid Ahsan, ShareChat is a Bengaluru-based social media startup. It positions itself as an Indic language social media platform, with an average user time spent of 31 minutes daily.

Currently, ShareChat is the highest valued social media platform in India. It competes with Chingari, Mitron, and DailyHunt’s Josh, among others.

It crossed the unicorn valuation in April 2021 after raising $502 Mn in a funding round. The unicorn raised $913 Mn in funding in 2021 alone. It has raised $1.77 Bn across all rounds to date and is backed by the likes of Google, Lightspeed, Temasek Holdings, Tiger Global, Twitter, and Xiaomi, among others.

ShareChat merged with short video platform MX TakaTak in a $700 Mn deal in February 2022.

slice

Founded in 2016 by Rajan Bajaj, slice is a fintech startup that offers payment cards and credit cards to millennial and Generation Z customers.

The startup issues credit cards and payment cards to this segment in partnership with Visa and SBM Bank, while also offering rewards and discounts on payments. The startup provides a credit line starting from INR 10,000 and going up to INR 10 Lakh. slice claims that it has a registered user base of over 5 Mn and a 40% month-on-month growth rate. It ships over 2,00,000 credit cards each month.

The fintech startup hit unicorn valuation in 2021 when it raised $220 Mn in its Series B round. It has raised almost $300 Mn from its 8 key investors, including Das Capital, Insight Partners, Pegasus Wings Group, and Tiger Global.

Spinny

Founded in 2015 by Niraj Singh, Mohit Gupta and Ramanshu Mahaur, Spinny is a Delhi-NCR-based online used car marketplace. Spinny competes against the likes of CarsTrade, Droom, Cars24, Cardekho, OLX, Quikr and OlaCars.

It operates across the entire value chain of pre-owned cars and claims to embed superior technology and processes to deliver a premium experience to customers. The startup has 15 car hubs that operate across eight cities – Delhi-NCR, Bangalore, Mumbai, Pune, Hyderabad, Chennai, Kolkata, and Ahmedabad.

Spinny hit unicorn valuation in 2021 after raising $283 Mn in a Series E funding round, in which its valuation soared to $1.8 Bn from around $800 Mn in the round before. It has raised more than $530 Mn in various funding rounds to date. Spinny is backed by the likes of Abu Dhabi Growth Fund, Accel, Elevation Capital, and Tiger Global Management, among others.

upGrad

Ronnie Screwala-led edtech startup upGrad entered the unicorn club in August last year. Founded in 2015 by Screwvala, Mayank Kumar, Phalgun Kompalli, and Ravijot Chugh, it offers higher education courses in collaboration with various universities. The startup last raised $185 Mn in a funding round led by Singapore’s sovereign fund Temasek at a valuation of over $1.2 Bn.

The startup has been on an acquisition spree this year. It has acquired Insofe, Talentedge, and Work Better this year.

Urban Company

Gurugram-based hyperlocal services startup Urban Company was founded in 2014 by Abhiraj Bhal, Raghav Chandra, and Varun Khaitan. The startup offers a range of services from beauty and spa at home to appliance repairing. It achieved the unicorn status in June last year after bagging $255 Mn in its Series F round.

The startup is backed by marquee investors like US-based Tiger Global, Steadview Capital, Vy Capital, among others. Earlier this year, Inc42 had exclusively reported about Urban Company’s foray into medical video consultation.

Vedantu

Bengaluru-based K12 focussed edtech startup Vedantu was founded in 2014 by Vamsi Krishna, Anand Prakash, and Pulkit Jain. The startup offers an interactive online tutoring platform. Currently, over 35 Mn students attend its live classes every month, with teachers delivering 8 Mn+ hours of live classes.

Last month, the startup launched an immersive platform W.A.V.E 2.0 to bring further innovation in live classes.

Vedantu entered the unicorn club in September last year after raising $100 Mn led by Temasek, ABC World Asia, Tiger Global among others.

Zeta

Founded in 2015 by Bhavin Turakhia and Ramki Gaddipati, Zeta offers cloud-native neo-banking platform for the issuance of credit, debit and prepaid products. It also provides digitised solutions to enterprises such as automated cafeteria billing and more.

Headquartered in Bengaluru, Zeta serves big fintech firms and banks including Axis Bank, Kotak Mahindra Bank, Yes Bank, Induslnd Bank, and HDFC Bank. Zeta has more than 1,300 employees across US, UK, Middle East, and Asia. The startup claims to have served eight issuers and 30 fintech firms. In total, Zeta says that it has issued more than 10 Mn cards.

Zeta entered the unicorn club in 2021, having raised $250 Mn in its Series C funding round led by Japanese conglomerate SoftBank. Recently, credit card giant MasterCard has invested in the fintech unicorn, and the two will bring co-branded credit cards soon.

Zetwerk

Founded in 2018 by Amrit Acharya, Srinath Ramakkrushnan, and Vishal Chaudhary, Zetwerk entered the unicorn club in August 2021 after raising $150 Mn from D1 Capital Partners.

The startup is a manufacturing services platform that connects manufacturing companies with vendors and suppliers for customised products, industrial machine components and other equipment. The startup reported sales of INR 828.6 Cr in FY21, while reducing its losses to INR 41.2 Cr.

Last year, Zetwerk raised $210 Mn in a funding round led by GreenOaks Capital at a valuation of over $2.5 Bn valuation.

Unicorns In India: Indian Startups That Entered The Unicorn Club In 2020

Cars24

Founded in 2015 by Vikram Chopra, Gajendra Jangid, Ruchit Agarwal and Mehul Agrawal, Cars24 is an ecommerce platform for pre-owned vehicles, including cars and bikes. In 2019, it also procured a non-banking financial company (NBFC) licence from the Reserve Bank of India (RBI) to venture into consumer lending business.

In 2020, the Gurugram-based startup entered the unicorn club by raising $200 Mn in a Series E funding round led by DST Global. Within five years of its inception, it became the first used car marketplace to join the unicorn league.

FirstCry

Founded in 2010 by Supam Maheshwari and Amitava Saha, FirstCry offers different categories of baby and kids products from clothing to other essentials. Besides the online presence, the startup also has a retail footprint.

The Pune-based baby products marketplace turned unicorn in 2020 when it raised $296 Mn from Japan-based Softbank’s Vision Fund at a valuation of $1.2 Bn. Later, the startup raised around $315 Mn from TPG, ChrysCapital and Premji Invest. To date, the ecommerce unicorn has raised $741 Mn in funding.

The startup is gearing up for its initial public offering (IPO), and recently converted itself into a public company.

The Pune-based startup posted a profit after tax of INR 215.94 Cr in FY21, as against a loss of INR 190.8 Cr in FY20. FirstCry’s consolidated total revenue soared to INR 1,740 Cr, a 141.3% rise from INR 896.7 Cr in FY20.

Glance

While 2021 proved to be a watershed year for the Indian startup ecosystem, with 42 startups joining the unicorn club, the pandemic-hit 2020 was among the most difficult years for startups amid uncertainty. However, Glance was among the few startups which weathered the storm and entered the unicorn club in 2020. The startup, owned by adtech unicorn InMobi, turned unicorn after raising $145 Mn from Google and existing investor Mithril Capital.

Glance delivers AI-driven personalised content in multiple languages, including English, Hindi, Tamil, Telugu and Bahasa, on the lock screen of Android smartphones. The content includes trending news across a range of categories, such as entertainment, sports, and fashion, and is delivered in a visually rich format. In 2019, Glance also acquired Roposo, a short-video platform.

It must be noted that Glance was the second unicorn to emerge from Naveen Tewari founded InMobi group. Glance raised $200 million in its Series D round from Reliance-owned Jio Platforms in February this year. The Google and Reliance-backed startup recently launched Glance TV – a live, interactive content platform for the home screen of Android smart TVs.

Nykaa

Founded in 2012 by Falguni Nayar, Nykaa is an online marketplace for beauty and wellness products. After starting as an online platform, Nykaa also launched offline stores in 2015, and currently has 80+ outlets today across three formats, driving an omnichannel presence.

Fidelity Management and Research Company, Lighthouse Funds, Steadview Capital, Sunil Munjal, and TPG Growth are the key investors in the ecommerce platform. Besides, it also counts Bollywood stars Katrina Kaif and Alia Bhatt as investors. Nykaa hit unicorn valuation in 2020 after raising two funding rounds in March and May from Steadview Capital, reaching $1.2 Bn in valuation.

Nykaa went public in 2021, with its shares listing at a huge premium on the stock exchanges over its IPO price. On the NSE, its shares were listed at INR 2,018, higher by 79.37% than the issue price of INR 1,125. On the BSE, the shares are listed at INR 2,001 apiece. Nykaa’s shares closed at INR 1,643.60 on the BSE on Wednesday (May 4).

Pine Labs

Founded in 1998 by Lokvir Kapoor, Tarun Upaday and Rajul Garg, Pine Labs is a fintech startup that enables businesses to accept online and offline digital retail transactions.

The startup claims that its cloud-based platform powers over 1,40,000 merchants, and 3.5 lakh PoS (point of sale) terminals across 3,700 cities and towns in India and Malaysia. The fintech unicorn also claims to process $30 Bn of transactions per year.

Pine Labs attained unicorn valuation in 2020. Since becoming a unicorn, the fintech startup has raised multiple rounds of funding, taking its current valuation to $5 Bn. It counts Flipkart, Investco, Lone Pine Capital, Mastercard, PayPal Ventures, Sequoia Capital India, Temasek Holdings, and Alpha Wave Ventures among its key investors. It has raised $1.4 Bn across various funding rounds and is eyeing a US listing this year.

Postman

Founded in 2014 by Abhinav Asthana, Abhijit Kane, and Ankit Sobti, Postman is a San Fransico and Bengaluru-based B2B SaaS startup. Postman helps developers and companies build new applications through the application programming interface (API) workflow.

Postman boasts of more than 17 Mn users and 500K organisations on its platform. The startup said that 98% of its clients are Fortune 500 companies, including the likes of Salesforce, Cisco, PayPal, and Microsoft. The company recently announced that its public API Network is now the largest API hub in the world, with more than 75,000 APIs shared on the network.

The SaaS startup hit unicorn valuation in 2020, raising $150 Mn in a Series C funding round. In 2021, it raised another $225 Mn in funding, becoming India’s highest-valued B2B SaaS startup, at a valuation of $5.6 Bn. It counts CRV, Insight Partners, and Nexus Venture Partners among its key investors.

Razorpay

Founded in 2014 by Harshil Mathur and Shashank Kumar, Razorpay is a Bengaluru-based B2B fintech startup that provides APIs for payment gateways to other companies. It started as a payments gateway but has now expanded to provide services such as SME payroll management, banking, lending, and payments, among others.

According to Razorpay, it powers payments for 34 of the 42 startups that turned unicorn in 2021. It achieved $60 Bn TPV (Total Payment Volume) as of early December 2021 and plans to achieve $90 Bn TPV by the end of 2022.

It hit unicorn valuation in 2020 after raising $100 Mn from existing investors and GIC. Since then, it has raised another $535 Mn in two funding rounds, taking its total fundraising to well over $739 Mn and its valuation to $7.5 Bn. Razorpay is backed by marquee VC firms such as Sequoia Capital India and Tiger Global Management, along with the likes of MasterCard and Salesforce.

Unacademy

Bengaluru-based Unacademy is currently the country’s second most valued edtech startup after BYJU’S. Initially founded as a YouTube channel, founders Gaurav Munjal, Roman Saini, and Hemesh Singh officially registered Unacademy in 2015.

The startup was the second in the edtech segment, after BYJU’S, to achieve the unicorn status in September 2020, when it raised $150 Mn in a round led by Japan’s SoftBank.

The startup has to date raised close to a billion dollars in funding, counts Tiger Global, General Atlantic, Blume Ventures, Steadview Capital, and Sequoia Capital among its investors.

Unacademy, which mostly focuses on test prep and upskilling, claims to have more than 50,000 registered educators and more than 62 Mn learners. The startup offers content in 14 languages across 5,000 cities.

VerSE Innovation (DailyHunt)

Founded in 2009 by Umesh Kulkarni and Chandrashekhar Sohoni as NewsHunt, the Bengaluru-based content startup rebranded as DailyHunt in 2015. NewsHunt was acquired by VerSe Innovation in 2012.

DailyHunt parent VerSe Innovation became India’s first tech unicorn focused on vernacular content after raising $100 Mn funding from Google, Microsoft and Falcon Edge’s Alpha Wave Incubation in December 2020.

Recently, VerSe Innovation raised $805 Mn in a round led by Canada Pension Plan Investment Board (CPPIB), Ontario Teachers’ Pension Plan Board (OTPPB), Luxor Capital and Sumeru Ventures. The deal is the largest investment round in 2022 so far, followed by Byju’s $800 Mn.

Dailyhunt claims to have 350 Mn+ monthly users, while it offers content in 15 languages from an ecosystem of over 100K content partners and individual content creators. Its parent company incurred a total consolidated loss of INR 807.9 Cr in FY21, almost a 97% jump from a loss of INR 410.2 Cr in FY20.

Zenoti

Spa and salon software startup Zenoti entered the unicorn club in December 2020, when it raised $160 Mn in a funding round led by Advent International and Sunley House Capital, along with Tiger Global and Steadview Partners.

Founded by Sudheer Koneru and Dheeraj Koneru in 2010, Zenoti is an all-in-one cloud-based software for spas, salons, and medi-spas.

Later, in the first half of 2021, the startup bagged $80 Mn, led by TPG Global, at a valuation of $1.5 Bn.

Zerodha

Founded by brothers Nithin Kamath and Nikhil Kamath, Zerodha is one of the few Indian startups that is often looked at as a successfully run business. It is among the handful of Indian startups to have entered the unicorn club without raising any money from external investors.

The startup continues to remain bootstrapped, completely operating on the basis of its earnings.

Zerodha, which entered the unicorn club in 2021, posted total revenue of INR 2,729.6 Cr in FY21, a 2.5X rise from INR 1,093.7 Cr in FY20. Its total profit stood at INR 1,122.3 Cr in FY21, an increase of 164.7% from INR 423.9 Cr in FY20.

Checkout The Indian Unicorn Tracker

Unicorns In India: Indian Startups That Entered The Unicorn Club In 2019

BigBasket

Founded in 2011 by VS Sudhakar, Hari Menon, Vipul Parekh, V S Ramesh and Abhinay Choudhari, the grocery delivery startup BigBasket has not only evolved but also witnessed a rapid change in consumer behaviour, especially during the pandemic.

However, even before the online grocery delivery segment went mainstream in India, BigBasket turned unicorn by raising $150 Mn in its Series F funding round in 2019. Last year, Tata Digital acquired a majority stake in the online grocery startup. Riding on the recent wave of quick commerce, BigBasket has also launched the express delivery service BB Now.

Delhivery

Delhivery became the first Indian logistics startup to enter the coveted unicorn club in 2019 after SoftBank invested $413 million from its Vision Fund in it.

Founded in 2011, the Gurugram-based startup offers logistics services such as express parcel transportation, LTL (less than truckload) and FTL (full truckload) freight, reverse logistics, cross-border, B2B & B2C warehousing, end-to-end supply chain services and technology services.

The logistics unicorn is gearing up for its initial public offering (IPO) which will open for the public on May 11 and close on May 13.

The price band for the IPO has been set at INR 462-487 per share.

Dream11

Founded in 2008 by Harsh Jain and Bhavit Sheth, Dream11 offers its users fantasy gaming in categories such as cricket, football, kabaddi, among others. The Mumbai-based fantasy gaming startup joined the Indian unicorn club with an investment round led by Steadview Capital in April 2019. It became the first gaming startup to achieve a $1 Bn-plus valuation.

Last year, ahead of the beginning of the new Indian Premier League (IPL 2021) season, Dream Sports, the parent company of Dream11, announced the completion of a $400 Mn secondary investment led by TCV, D1 Capital Partners and Falcon Edge. The funding round helped Dream11’s valuation inch closer to $5 Bn. It also claims to have reached 14 cr users in 2021.

Dream11 saw a 53% growth in its revenue from operations in FY21. The gaming unicorn posted INR 2,554.4 Cr in revenue from operations in FY21, as compared to INR1,670.2 Cr earned in FY20.

Druva

Founded in 2008 by Jaspreet Singh, Milind Borate, and Ramani Kothandaraman, Druva offers cloud data protection and information management solutions to enterprises by leveraging the public cloud with an integrated cloud management console.

NASA, pharma giant Pfizer, hotel chain Marriott, the US National Cancer Institute, and global logistics player DHL are among its clients.

The Pune-based startup joined the unicorn club after it raised $130 Mn in June 2019 in a round led by Viking Global Investors. Last year, it raised $147 Mn in a new round of funding at a valuation of over $2 Bn.

Icertis

Founded in 2009 by Monish Darda and Samir Bodas, Icertis is SaaS company that provides contract management services to enterprises. The company’s flagship product, Icertis Contract Management (ICM), can manage sell-side, buy-side, and corporate enterprise contracts across the globe.

The Seattle and Pune-based software company joined the unicorn club in 2019 after it raised $115 Mn in a funding round led by US-based venture capital firm Greycroft and PremjiInvest. Earlier this year, Icertis raised an undisclosed amount from German-based SaaS giant SAP. With this funding round, Icertis’ valuation reportedly reached $5 Bn.

Icertis also provides business applications to manage clinical trials, collaboration modules, GDPR compliance, risk management, among others. The company caters to multiple industries such as financial services, healthcare, pharmaceutical, retail, and manufacturing industries.

Lenskart

Founded in 2011 by Amit Chaudhary and Peyush Bansal, Lenskart is a Delhi-NCR-based vertical ecommerce startup for the eyewear segment, and other eye care products and services.

The company claims to reach 100K customers per month. Lenskart also boasts of serving more than 7 Mn customers annually through its omnichannel shopping experience, which spans online, mobile application, and over 750 omnichannel stores in 175 cities across the country.

In 2021, Lenskart launched ‘Vision Fund’ under which it would invest $2 Mn in selected startups synergistic to the eyewear, eye care, and omnichannel retail sectors.

Lenskart became the first D2C startup to reach unicorn valuation when it raised $231 Mn from SoftBank in 2019. Recently, it raised $24.7 Mn in a fresh round of investment from its existing investor Epiq Capital, taking its total fundraising to date to well over $770 Mn.

Ola Electric

Initially established as Ola’s EV venture in 2017, Ola Electric Mobility was set up as an independent entity in March 2019. The company makes electric two-wheelers, while also running pilots for the country’s electric charging infrastructure, including charging stations and battery swapping stations.

The company has invested INR 2,400 Cr in building the largest EV manufacturing facility in the country. The EV unicorn sold 9,121 e-scooters in March 2022, according to reports. It also plans to expand into four-wheeler EVs.

The company has 12 key investors, including Falcon Edge Capital, Hyundai Motor Company, Kia Motors, Softbank, Tata Sons, Tiger Global Management, and Edelweiss. Ola Electric has raised around $863 Mn across various funding rounds to date. It crossed the $1 Bn valuation mark after it raised $250 Mn in Series B funding in 2019. Most recently, the e-mobility startup raised $200 Mn in January 2022, taking its valuation to $5 Bn.

Unicorns In India: Indian Startups That Entered The Unicorn Club In 2018 & Before

![Indian Startups That Entered The Unicorn Club In 2018 & Before]()

2018

Billdesk

Founded in 2000 by MN Srinivasu, Ajay Kaushal, and Karthik Ganapathy, Indian payments gateway startup BillDesk took almost two decades to achieve unicorn status. Mumbai-based IndiaIdeas.com Ltd, which operates BillDesk, joined the unicorn club in 2018 after a funding round.

Later in 2021, Prosus, a global consumer internet group that operates fintech company PayU, acquired BillDesk for $4.7 Bn. At that time, it was touted as the largest acquisition deal in India’s fintech space. The deal also gave exit to investors General Atlantic, TA Associates, Temasek, Clearstone Ventures, and Visa.

As per reports, the Competition Commission of India (CCI) sought more information on the acquisition and its implications from PayU earlier this year. PayU India reportedly filed a revised merger notification with the antitrust watchdog a week ago.

BYJU’S

Founded in 2011 by Byju Raveendran, BYJU’S was the first edtech unicorn in India. The startup has a presence in 7 countries and more than 150 Mn students on its platform. BYJU’S flagship app, BYJU’S – The Learning App, has students from more than 1,700 cities.

In March 2022, BYJU’S, which is reportedly gearing up for its initial public offering, raised $800 Mn in a strategic funding round led by CEO and founder Byju Raveendran, Sumeru Ventures, Vitruvian Partners, and BlackRock. With this round, Raveendran became the third Indian founder to invest in his own startup. The round also helped the company valuation soar to $22 Bn.

The edtech platform has been named as the official sponsor of FIFA World Cup Qatar 2022. With this partnership, the edtech startup became the first Indian company to be associated with the FIFA World Cup.

Checkout The Indian Unicorn Tracker

Freshworks

Founded by Girish Mathrubootham and Shan Krishnasamy in 2010, Freshworks offers a suite of softwares for customer management, which includes an artificial intelligence-powered chatbot and messaging platform for customer support, as well as call centre-based solutions for customer service resolutions.

The SaaS startup entered the unicorn club eight years after its incorporation when it raised $100 Mn from Sequoia Capital, Accel Partners and CapitalG. While SMBs have been a major focus area for the company since the beginning, it has also scaled up the number of mid-market enterprise clients in the last couple of years.

Mathrubootham, who is regarded as a veteran of the Indian SaaS industry, also successfully led the public listing of the company. Last year, the company became the first Indian SaaS startup to list on Nasdaq. As it made a stellar debut on the stock exchange, its market crossed $12 Bn on the first day itself. Interestingly, over 500 of its shareholding employees in India became ‘crorepatis’ following the listing.

OYO

Founded in 2013 by Ritesh Agarwal, OYO is one of the leading travel tech platforms in the country which provides accommodation and other solutions to users. OYO partners with hotels and lists them on its platform. Users can make hotel bookings as per their requirements.

OYO has also expanded into providing technology solutions for hospitality facilities. The hospitality startup has expanded to more than 157K storefronts that use its full-stack hospitality technology solutions.

The hospitality unicorn is backed by marquee investors such as Masayoshi Son’s SoftBank, NASDAQ-listed Airbnb, Lightspeed Venture Partners, and Innoven Capital, among others. The startup has raised almost $4.5 Bn to date from 26 investors across various funding rounds.

OYO turned unicorn in 2018. Soon after, it raised a mammoth $1 Bn in a single funding round, valuing the traveltech startup at $5 Bn. The startup has also filed the DRHP for an IPO worth INR 8,430 Cr.

Paytm Mall

Paytm Mall, the ecommerce arm of Paytm, was established in 2017 by Paytm founder Vijay Shekhar Sharma. The ecommerce marketplace offers products in fashion, grocery, electronics, entertainment, beauty and health, and travel and holidays segments. It has partnered with multiple brands for the same.

Based on China’s TMall retail model, Paytm Mall operates as an independent entity and a consumer shopping app.

The ecommerce arm of the fintech decacorn earned unicorn status when it raised $445 Mn in a funding round from SoftBank and Alibaba at a valuation of more than $1.6 Bn. Paytm Mall counts Softbank Vision Fund, Alibaba Group, and eBay among its key investors. It has raised $645 Mn across various funding rounds so far.

PhonePe

Founded in 2015 by Burzin Engineer, Rahul Chari, and Sameer Nigam, PhonePe is a fintech platform that provides multiple financial services such as bank transfers, UPI-based payments, mobile recharges, and bill payments. The company has also diversified into providing digital insurance and other related services.

PhonePe was acquired by ecommerce giant Flipkart in 2016. According to the National Payment Corporation of India’s (NPCI’s) latest data, PhonePe is the biggest UPI app in terms of transaction volume as well as transaction value. The fintech startup saw more than 2.5 Bn transactions, worth more than INR 4.71 Tn, in March 2022.

PhonePe achieved unicorn status in 2018, merely 3 years after its incorporation. The fintech unicorn has raised more than $1 Bn in funding since 2016. Most recently, PhonePe’s Singapore-based parent company received $297 Mn in funding from Flipkart.

Policybazaar

Founded in 2008 by Yashish Dahiya, Avaneesh Nirjar, and Alok Bansal, Policybazaar aggregates insurance policies from a range of providers for use-cases, including life insurance, automobile insurance, health insurance and more.

Its parent company, Gurugram-based eTechAces Marketing and Consulting Pvt Ltd, also runs PaisaBazaar, a marketplace for loans and credit cards. Policybazaar became a unicorn in 2018, 10 years after its incorporation when it raised $200 Mn from SoftBank Vision Fund and InfoEdge. Its current valuation is well over $6 Bn.

Backed by the likes of SoftBank, Tencent, Tiger Global Management, True North, and Falcon Edge Capital, among others, the company has raised more than $700 Mn in various funding rounds. Policybazaar was listed on the stock exchanges in 2021, with an INR 6,017 Cr IPO.

Rivigo

Founded in 2014 by Deepak Garg and Gazal Kalra, Rivigo is a Delhi-NCR-based logistics startup. The company owns trucks and operates across multiple parts of India. Rivigo’s website claims that it owns a fleet of more than 5,000 trucks, and is present in more than 4,000 cities, covering around 29,765 pin codes across India.

The logistics startup offers both part-truck and full-truck deliveries, and also provides the option for cold-chain deliveries, along with various pre-and post-delivery support services. Rivigo also launched the National Freight Index (NFI) to bring transparency to the largely unorganised logistics sector.

Rivigo first hit the unicorn valuation in 2018, when it raised $50 Mn in a Series D funding round. After it, its valuation declined to below $1 Bn for a short while but again crossed the threshold in 2019, raising $65 Mn in a Series E round. Warburg Pincus and SAIF Partners are among its key investors.

Swiggy

Founded in 2014 by Nandan Reddy, Rahul Jaimini and Sriharsha Majety, Swiggy is a food and groceries delivery decacorn, though it likes to call itself a logistics company.

Since starting as a food delivery company, Swiggy has diversified into providing intra-city delivery services with Swiggy Genie and hyperlocal grocery delivery services with Swiggy Instamart (in which it invested $700 Mn last year). The startup will also offer online restaurant table booking with its acquisition of Dineout for $200 Mn earlier this year.

Currently, it claims to have more than 150K restaurants on its network, with a presence in more than 500 cities.

While Swiggy achieved unicorn status in 2018, it achieved the hallowed decacorn status in January 2022 after it raised $700 Mn in a funding round. So far, it has raised $4.4 Bn across multiple funding rounds. It is backed by Accel, SoftBank, Alpha Wave, Investco and Goldman Sachs, among others.

Udaan