![#StartupIndia: 74 Defining Moments From India’s Startup Ecosystem In The Last 5 Years]()

Announced five years ago on 15 August 2015 and launched in January 2016, Startup India is often called the current Narendra Modi government’s pet projects and for good reason. The ‘Startup India, Standup India’ slogan ignited the spirit of entrepreneurship in India. Backed by a slew of policy reforms such as funding support, bilateral government collaborations with various countries, as well as a range of policies in various sectors, Startup India also brought Indian startups to the global tech discourse.

With a consistent messaging of hope and pride in Indian tech, Startup India attracted entrepreneurs from every corner of India. So what has been the impact of these initiatives in the past five years? Here’s a look at how Startup India changed the game from 2016 to now.

Moments By Numbers

1. From 29K startups in 2014, the numbers grew exponentially from 2015-2018 to touch 55K in 2020. Between 2016 and August 2020, Startup India programme says it has recognised over 34.8K startups.

2. $63 Bn has been invested in Indian startups in the last five years. The Indian tech startups raised about $13.5 Bn in funding across 885 deals in 2017, which is the peak year in terms of funding in the past five years.

3. From 10 unicorns in 2016, India now has 33 startups that have attained the unicorn status

4. 53 Indian startups have the potential to join the unicorn club by 2022, as per the latest analysis by DataLabs by Inc42+

5. Flipkart’s $16 Bn acquisition by Walmart became the largest ecommerce deal globally and brought the retail giant’s full attention to the Indian market. Since then Flipkart seems to be focussing on several categories such as B2B supply, logistics and warehousing, hyperlocal dark stores and even alcohol delivery.

6. Udaan became the fastest Indian startup to acquire unicorn status i.e. 26 months. As per DataLabs research of a sample set of 31 Indian unicorns over the years, the contribution of 2019 was 26% (till Q3 2019) — seven startups reached this mark the same year. The Datalabs by Inc42 report on the state of the ecosystem till Q3 2019 indicates that the median founding year for the unicorns in India is 2010, which is also the year when MakeMyTrip became India’s first unicorn.

7. 665 Indian startups have been acquired in the last five years. 2019 noted that the ecosystem saw 111 M&A deals in the year, recording a 10% Y-o-Y fall. This is the lowest number of mergers and acquisitions deals between 2015 and 2019.

8. BYJU’S became the world’s most valuable edtech unicorn and is currently valued at $10.5 Bn and recently made waves with a $300 Mn acquisition of WhiteHat Jr, an 18-month-old company, the largest venture exit in Indian edtech history.

9. From 2000 investors in 2016, India has seen participation of 4,640 investors in the startup funding. DataLabs by Inc42+ has noted that that the number of unique investors in 2019 saw a minor fall as compared to the last three years, from a peak of 315 unique VCs in 2017.

10. 30 Indian states including UTs have introduced startup policies and many of them have existed well before the Startup India programme came into effect. The state policies of Kerala, Maharashtra, Karnataka have been particularly successful, while Delhi government is looking to renew its startup policy later this year.

11. 34.8K startups have been recognised by DPIIT. Among these, 8.3K startups received intellectual property rights (IPR) fee benefits, while over 2.6 Lakh people enrolled in the entrepreneurship-focused learning courses offered by upGrad and Startup India.

12. Over $1 Mn worth benefits were given to 5.5K startups as part of over 150 startup innovation programmes and challenges under Startup India programme.

13. SIDBI has released INR 700 Cr and committed INR 3,123 Cr to 47 AIF, while INR 695.94 Cr has been withdrawn from the Startup India fund of funds. To make the investment procedure simpler for the startups and the government, fund of funds also went digital in July 2019 through a web-based application.

14. INR 3,476 Cr has already been invested in 323 startups from the fund of funds corpus managed by Startup India through Invest India.

15. Startup India enabled global market access and knowledge for Indian startups through bilateral government collaborations with Russia, South Korea, Portugal, Japan, Netherlands, United Kingdom, Sweden, Finland, Israel, and Singapore.

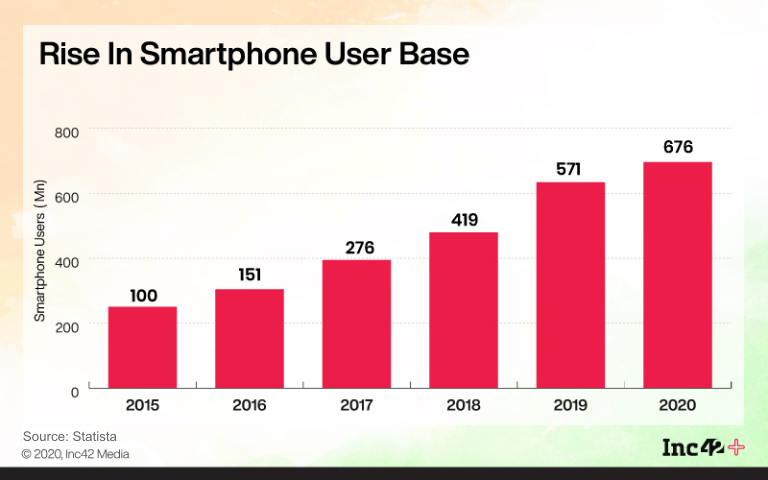

16. India changed the startup definition in February 2019 to recognise companies as startups for up to 10 years from the incorporation date, plus the turnover limit has been increased to INR 100 Cr from INR 25 Cr earlier.

Digital India Moments

17. India is consistently improvising on ease of doing business rankings by the World Bank. Compared to 142 rank of India in 2015, India was ranked 63rd among 190 countries on

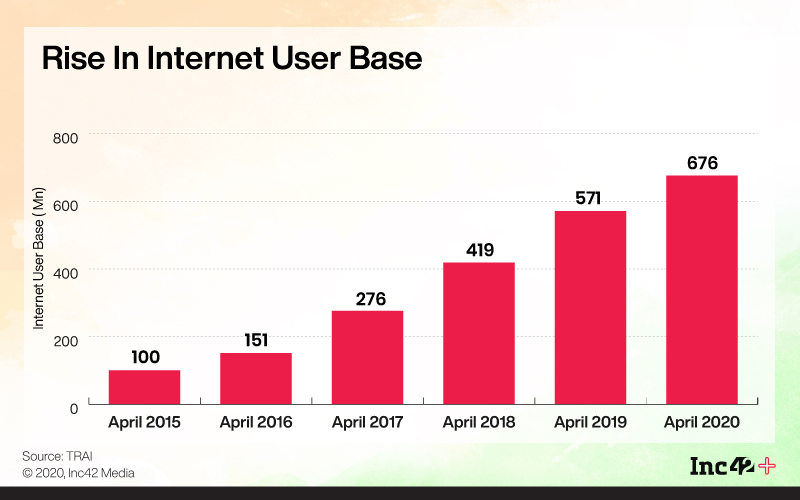

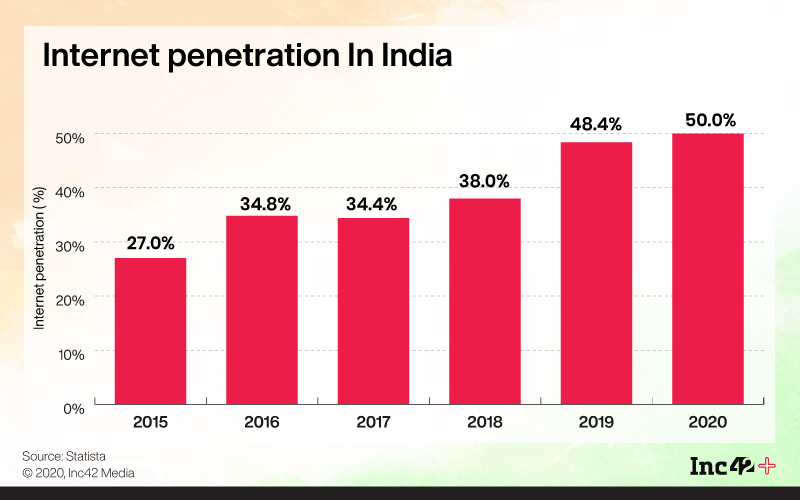

18. India now has 676 Mn broadband subscribers (including both wireless and wireline connections) and 1149 Mn wireless telephone subscribers, out of which 629 Mn are urban subscribers.

19. The country has witnessed increased penetration of smartphones thanks to the proliferation of affordable devices made in China. The ensuing price wars and the government’s push for Make in India eventually led to the growth of the smartphone manufacturing market in India, which has further pushed the cost down. Today, India has close to 450 Mn smartphone users (as of July 2020) and is the fastest-growing smartphone market in the world.

20. 1.42 Lakh Gram Panchayats are connected with optical fiber under the BharatNet programme which seeks to bring internet connectivity to all villages. The programme is closely linked to the Digital India mission as well as the plan to create Digital Villages to complement the smart cities model. As of now, there has been no progress on the digital villages front beyond the announcement.

21. The new education policy lays emphasis on digital education and remote learning opening doors for edtech startups, where they can help schools, students and teachers in providing a seamless experience, thereby enabling students to identify their interest areas and skills.

22. In terms of gender diversity across workspaces in India, just 9% of the board members of the top 20 unicorn startups in India are women. To boost participation of women entrepreneurs in the startup ecosystem, 10% of the INR 10K Cr Funds of Funds has been reserved for women-led startups.

23. During the pandemic and the resultant lockdown, India crossed 500 Mn internet users with 504 Mn active internet users, backed by a huge surge in rural and semi-urban users. ![]()

24. The Indian tech industry has grown to become one of the largest startup ecosystems in the world. In 2019 alone, Indian startups raised over $12.7 Bn and by 2021, startups are likely to cross the $15 Bn mark in terms of funding too. Backing the investors are over 200 incubators and accelerators that are crucial in identifying sources of innovation early on. The likes of Nascomm’s 10000 Startups, Kerala Startup Mission, Maker Village, T-Hub in Telangana, BIRAC, Bhamashah Technology Park in Rajasthan and more have led the path for incubators in India.

25. In March 2018, SEBI had rolled out a list of top 1000 listed companies which were mandated to appoint at least one woman director in their board by March 2020. As on December 31, 2019, 977 of that top 1,000 companies had a woman director, and 835 of them had a women independent director. This is a sharp jump from 379 women directors and only 193 women independent directors back in March 2014. In 2018, these top listed companies appointed 974 women directors overall, and 660 female independent directors.

26. According to the latest report published by the Internet and Mobile Association of India (IAMAI), 65% of the Indian internet users are male while the remaining 35% are female.

27. In June 2019, B2B ecommerce platform IndiaMART joined the likes of MakeMyTrip, Justdial, Matrimony, Info Edge and others as a public listed tech company. IndiaMART posted over 64% increase in net profit at INR 74.6 Cr in Q1 FY 2021.

Policy Moments

28. To ensure steady and quick medical services for even those stuck at home and unable to venture out, the Indian government launched a set of guidelines for telemedicine or remote healthcare on March 25, 2020, the same day as the lockdown began. With the guidelines in place, many more startups have emerged in this field to fix the access gap.

29. After years of court battles and legal hurdles and despite rising adoption for epharmacies, online pharmacy startups still await guidelines and clarity on regulatory aspects. That has not stopped new players from launching services. Amazon has entered the fray recently, with talks of Reliance Jio acquiring Netmeds. Most recently, The Internet and Mobile Association of India (IAMAI), which also represents epharmacies, urged the government to launch guidelines in June 2020 in line with its promises.

30. It is safe to say that India’s journey with digital payments truly only began in November 2016. While digital payment wallets and gateways existed well before 2016 too, the demonetisation which was announced on November 8, 2016 catapulted India into digital payments overnight. Backed by the success of UPI apps, individuals, service providers and merchants in Indian metros, Tier 1 cities and many Tier 2 cities these days all support cashless transactions through a variety of platforms.

Besides this, since 2002, the RBI has been planning the development of the payment systems under RBI’s vision document for the payment and settlement systems in India.

The latest vision document came in May 2019, emphasising on innovation, cyber security, financial inclusion, customer protection and competition. envisaged building best-in-class payment and settlement systems for a ‘less-cash’ India. Quantifying the growth, RBI said that digital payment transaction turnover vis-à-vis GDP (at market prices-current price) increased from 7.14% in 2016 to 7.85 in 2017 and further to 8.42 in 2018.

31. After more than a year of discussions, the government now claims there is no definite timeline for introducing the national ecommerce policy, which was proposed in 2018. In early 2019, DPIIT had released the draft ecommerce policy, proposing data localisation and streamlining of ecommerce operations in line with FD! rules.

32. In April 2018, the Indian government announced the formation of a 13-member task force to work on the policy regarding manufacturing and licensing of drones, airspace and air traffic management and more. The drone policy, named Drone Regulations 1.0, came into effect from December 1, 2018. In January 2019, India released the draft note for Drone Regulations 2.0.

33. The estimated market opportunity in the vernacular content segment in India is $53 Bn (2021) and given the lucrative market opportunity, the government and tech giants have ramped up investments for regional language-focussed startups. In its $10 Bn Google For India Digitization Fund, Google said a portion of the money would be invested in regional language platforms, while the ban on Chinese apps in June 2020, has added a stronger spotlight on this segment.

34. Among the controversial reforms by the government despite its push for startups, the angel tax or Section 56 (2) (vii)(b) of the Income Tax Act is definitely on the top of the list. It ruled that a privately held company issues its shares at a price more than its fair market value, the amount received in excess of the fair market value will be taxed as income from other sources. Since November 2018, more than 2,000 startups that had raised money since 2013 got notices from tax authorities and though the situation has been clarified for DPIIT-registered startups, many of those which are not will continue to be targetted by angel tax. Like clockwork, every year, startups call for the government to ease the rules and relax the tax burden, but the ghost of angel tax continues to linger on.

35. India launched the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme for a two-year period at an approved outlay of INR 795 Cr in 2015. The scheme, extended till September 2018, focussed on technology development, demand creation, pilot projects and charging infrastructure. Under phase II, India is planning to extend financial support of INR 8,730 Cr to EV industry for three years.

36. On May 16, 2020, the government announced a technology push for private sector participation in the defence and space sectors which plans to link the startup ecosystem with the nuclear sector, as part of the larger reforms to boost the economy in a post-Covid-19 world. Finance minister Nirmala Sitharaman announced separate budgetary provisions for procuring only India-made defence items, a hike in foreign direct investment limits, private sector participation in outer-space travel and inter-planetary exploration and technology incubation centres for private companies linked to nuclear research.

37. The Startup India policy is not only about enabling existing businesses. It enforced a slew of policy reforms such as funding support, bilateral government collaborations with various countries, and consistent messaging of hope and pride in Indian technology, products and services. Post the launch, 26 state governments also released their own startup policies, with state-sponsored Atal Incubation Centres driving grassroots innovation since 2016.

38. Recognising the double taxation issue in the case of employee stock option plans (ESOPs), finance minister Nirmala Sitharaman announced at the FY 2020-21 Union Budget that tax at the time of exercise can be deferred by up to five years or till an employee leaves the company or when they sell their shares, whichever is earliest. However, going through the Finance Bill 2020, soon it became clear, that the ESOP-related announcement will benefit just about 250 startups in the country in contrast to the over 55K startups in India.

39. Established in January 2009, the Unique Identification Authority of India (UIDAI) and the 12-digit Aadhaar ID have changed the game for billions of Indians. With direct delivery of financial and other subsidies, linkage to financial accounts and mobile numbers, Aadhaar has become a central part of many digital services in the fintech and banking sectors. However, Aadhaar has had a controversial life with several database leaks emanating from government departments. Plus, the rampant linking of Aadhaar to different branches of the government have led to privacy concerns from civil and legislative bodies.

40. After transforming fintech and banking through the India Stack project, the next agenda for India is the National Health Stack, which seeks to transform healthcare just as India stack did for fintech. Will structured data with consent layers baked into it allow the National Health Stack to finally bring India’s ailing healthcare infrastructure up to date with the times? The National Health Stack, which is a set of essential APIs, recently went live for testing. When implemented in the right manner, it will make telemedicine and other healthtech possibilities a reality with safety, interoperability, security and reliability being the primary pillars.

Envisioning a cohesive future for healthcare, dozens organisations and companies — National Cancer Grid, Swasth Alliance, LiveHealth, DRiefcase and others — have begun testing the newly built National Health Stack APIs in the past few weeks. But there’s still a long way to go before there’s full-fledged innovation built on the health stack.![]()

41. The Covid-19 pandemic has further pushed the telemedicine and teleconsultation in India, Though the data for the same is still unavailable, but PM Modi had come on record to say that telemedicine and teleconsultation are at the same path of success as digital payments with growing numbers and integration, however, there is still scope of innovation here.

42. The crowning glory of India’s many fintech-related developments, the unified payments interface or UPI is a real-time instant payments system for individuals and merchants. Since April 2016, UPI has become the de facto face of digital payments. UPI has witnessed over 1,029 Cr transactions until August 2019 with a total of INR 17.29 Lakh Cr (or $240 Bn) processed since its launch.

43. It would be impossible to recount the various taxation reforms over the past 73 years, but the biggest changes in recent times came last year with the Taxation Laws (Amendment) Ordinance 2019 passed in September 2019. India slashed corporate tax rates to 22% for existing domestic companies and 15% for new domestic manufacturing companies. Other measures were also taken to grant tax relief to corporates, thereby making the total revenue foregone estimated at INR 145K Cr ($20 Bn).

While providing relief to some Indian companies, India is also looking to increase its share of revenue earned through tax from tech giants such as Google, Facebook, Twitter, and Amazon. All of these have massive audiences in India, but while they generate revenue in the country from digital services, the businesses operating these services often are not located in India. Businesses without any physical presence in India may reportedly have to pay a 30-40% digital tax for the revenue generated from sale of digital services.

44. On July 1, 2017, the Goods and Services Tax (GST) was rolled out for all businesses and professionals in India. With the motto of ‘one country, one tax’, the GST regime envisioned India as a single commercial union. It was the biggest tax reform (in the indirect taxation) in India’s history and while the repercussions of such a big change and the implementation are still being felt, many economic experts believe that it was a necessary step for the Indian economy. Announced in 2000, the GST took 17 years to come into effect.

It consolidated levies such as State Value-Added Tax (VAT), Central Excise, Service Tax, Entry Tax or Octroi, Customs Duty, Central Surcharge & Cess, Luxury Tax, Entertainment Tax, and Purchase Tax along with a few other indirect taxes.

45. In January 2020, the Niti Aayog released “Blockchain: The India Strategy – Towards Enabling Ease of Business, Ease of Living and Ease of Governance” discussion paper which sought to maximise the potential of blockchain for India’s needs. The paper delved into the functional definition of the entire suite of blockchain or distributed ledger technologies along with legal and regulatory issues and other implementation prerequisites, specific use-cases for Indian market.

46. Among the most recent policy decisions to boost the Indian logistics and transport sector and create efficient channels for movement, India announced a new National Logistics Policy at the Union Budget 2020-21. The National Logistics Policy will clarify the roles of the government and key regulators and will look to create a single-window e-logistics market and focus on the generation of employment and skills.

It includes plans to develop 2500 Km access control highways, 9000 Km of economic corridors, 2000 Km of coastal and land port roads and 2000 Km of strategic highways. Together, these have contributed to the rise of ecommerce and logistics as major sectors in the Indian market. The quick turnaround time for delivery in metros is another indicator of how far India has come in the past few years.

47. While there are plenty of positives to take away from India’s flourishing startup ecosystem, job security and stable employment are not among them. The 24,848 DPIIT-recognised startups have together created over 3.06 Lakh jobs, under the Startup India scheme. But the high incidence of failed startups in the early and growth stages have made startup job losses ubiquitous and commonplace. The current Covid-19 pandemic has also had an impact on hiring and contributed to job losses. As per DataLabs estimates, the average percentage of layoffs in the total workforce in Indian startups is 22% between April and June 2020.

Bharat Moments

48. With the Startup India push, entrepreneurship has been a major agenda for colleges and universities and at the grassroots level in villages and rural India. A study by US mergers and acquisitions broker Latona last November revealed that India offers the fourth-highest level of business training and education in schools. The US-based company analysed the major startup ecosystems around the world on key indicators of entrepreneurial potential to reveal the world’s most entrepreneurial nations. India had a score of 7.41 out of 10, which showed positive growth in terms of innovation and upskilling.

On the rural level, the MSME ministry launched the SIDBI-administered ASPIRE Fund in October 2016 with a corpus of $8.9 Mn (INR 60 Cr) to promote entrepreneurship in rural India. Further, to improve the technology adoption by rural industries, the government envisions setting up 80 Livelihood Business Incubators (LBIs) and 20 Technology Business Incubators (TBIs) to develop 75,000 skilled entrepreneurs in agro-rural industry sectors.

49. As India is struggling to fight against the global pandemic, Indian startups have been arming the nation with their tech solutions. Whether it’s healthtech, supply chain or even grocery deliveries, Indian startups have been working hard to ensure that India services remain undisrupted even as the Covid cases are rising. Over the few months, NITI Aayog has onboarded startups to develop healthtech solutions and ventilators to boost India’s healthcare infrastructure, while the IT Ministry is relying on startups to make indegenious video conferencing solutions.

50. From floods in Orissa, Kerala and Chennai to the massive problems posed by Covid-19, startups have not only managed to keep innovating but have also contributed when they can. Most recently, many startups pitched into the various government funds for pandemic relief and also undertook social impact activities to help the needy in the times of crisis.

51. The Skill India Mission has been a cornerstone policy in the Indian government’s digitisation efforts. This year marks five years of Skill India Mission and over 1 Cr youth have enrolled under the initiative on a yearly basis. Till now, 67 lakh people have been trained, while 4.45 Lakh trainees have been given apprenticeship training every year, the government announced last July.

52. Acknowledging the recent innovations by fintech startups, the Reserve Bank of India (RBI) has released a draft ‘Enabling Framework for Regulatory Sandbox’ in 2019 that will allow fintech startups to test within a regulatory sandbox (RS). It’s said to be a stepping stone for the open banking standards that the neobanking segment desperately needs to fully innovate in the banking and financial services industry.

Backed by some private sector banks, startups are providing ‘open banking’ or ‘API banking’ services, which is essentially a “banking as a service’ model for plug-and-play models. However, a standardised open banking model will be the biggest enabler in the future of BFSI.

53. In the past 5 years, the Indian government has come up with a wide array of startup schemes and startup funds to encourage launch and growth of startups in the country. Over 50 startup schemes have been floated by the Indian government to date to support the Indian startups, SMEs, MSMEs, research institutes, incubators, accelerators and other enablers. The schemes have not only brought more grants and capital, but have also help startups secure patents more easily for their innovation. The number of intellectual property rights (IPR) filings from startups have nearly doubled in six years from 4,000 to 4,500 IPR filings per year.

54. In August this year, the government commissioned Niti Aayog to develop a network of banks and fintech companies who could give small-ticket loans to bottom-of-the-pyramid borrowers such as farmers, street vendors and labourers by utilising the existing direct benefit transfer (DBT) infrastructure. Fintech startups such as PhonePe, Kissht and Pine Labs are also said to have been part of the government’s review meetings for the proposed scheme.

55. Prime Minister Narendra Modi on August 15, 2020 launched the tech-based National Digital Health Mission (NDHM), under Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY), to revolutionise the Indian health sector. Each patient would be given an ID card, which was based on similar models as seen in the likes of UIDAI and GSTN. The card will include confidential medical data such as prescriptions, diagnostic reports, discharge summaries and more. The initiative will also allow the patients to access health services remotely through teleconsultations and epharmacies while offering other health-related benefits.

56. Startup funding in Tier 2 and Tier 3 cities improved by 3.2x in 2019 ($243 Mn) compared to 2014 ($74 Mn)

57. 219 startups in Tier 2 and Tier 3 cities raked in total venture capital funding of $1.03 Bn (2014 to H1 2020)

58. New startups in Tier 2 and Tier 3 cities are getting funded at a CAGR of 21%. Only 20% of the total funded startups in India are based in Tier 2 and Tier 3 cities, with over 5,800 startups in Tier 2 cities. The total funding for startups from Tier 2 cities alone is $1.3 Bn (2014-Q1 2019). However, when compared to Tier 1, there is a clear imbalance in startups and funding in Tier 2 and 3 cities.

59. The Indian government launched a National Seed Fund in the union budget of financial year 2020-21 to support ideation and development of early stage startups. The credit guarantee scheme will enable the startups to raise loans for their business purposes. Besides this, the RBI has added startups to the list of priority sector lending (PSL), which will allow them to borrow capital from banks smoothly.

60. Created under the Startup India programme, Atal Incubation Centres and Atal Tinkering Labs are dedicated works spaces where school students learn innovation skills. The labs are powered to acquaint students with state-of-the-art equipment such as 3D printers, robotics & electronics development tools, IoT and sensors.

In a bid to impart artificial intelligence (AI) basics to students, the National Association of Software and Services Companies (NASSCOM) has launched an AI-based educational module for school students. In collaboration with Niti Aayog’s Atal Innovation Mission (AIM), the programme is expected to teach AI to around 2.5 Mn students associated with Atal Tinkering Labs (ATL).

According to a recent study, the revenue of the AI industry was also doubled in 2019 from $230 Mn in 2018 to $415 Mn in India. Moreover, a PwC study estimates that the AI industry is expected to reach globally to $15.7 Tn with India having a noticeable share of this industry.

Global Moments

61. With Startup India, businesses in India got access to global markets and knowledge through bilateral government collaborations with Russia, South Korea, Portugal, Japan, Netherlands, United Kingdom, Sweden, Finland, Israel, and Singapore. This also brought in a wave of new investors to the Indian startup ecosystem. The likes of Sequoia Capital, Softbank, Tiger Global, Accel Partners have launched new funds with Indian startups on their targets.

Plus, over the years, new venture capital firms such as Peter Thiel’s Mithril Capital, which invested in GreyOrange in 2018, Cleartax investors Morningside Venture Capital, China’s oldest VC firm and Ola backers Hong Kong’s Sailing Capital have also made their way to India. In 2019 too, India saw new venture funds from the likes of 3One4 Capital, AngelList India, 100X.VC and corporate venture funds Microsoft M12 and Samsung Venture Investment Corporation.

62. With the coronavirus lockdown forcing people indoors, many individuals suddenly found themselves with a lot more free time and many jumped into career changes by following their passion to make a living. Skills, interests and hobbies are being thrown under the spotlight, as the newfound passion economy stretches from experts conducting online fitness or dance classes to curated newsletters to podcasts and vlogging collabs to content pieces such as videos or expert articles.

With the emergence of the passion economy has come a new wave of growth for platforms such as Substack, Patreon, OnlyFans, Masterclass, MasterSchool, Medium, upGrad, Unacademy as well as mainstream options like Twitch for gamers, Spotify for podcasters and YouTube and Vimeo for creators who want the largest reach.

63. The rising prominence for OTT platforms has not only brought a veritable threat to the established distribution market in the entertainment industry, but the independence of many of these platforms has been a godsend for Indian consumers from the point of view of content. The OTT wave has given rise to a wave of indie directors, producers and artists that have enriched India’s already vibrant movie and TV show landscape. One impact from the autonomy of OTT video platforms in India is that viewers are largely attracted by uncensored content on OTT platforms in India. This also gives producers a free rein to experiment with content. ![Violence, Sex & Nudity: The Dark Side Of OTT In India]()

64. The Indian government has banned 106 Chinese app since June 2020 and barred public and private entities from trading with Chinese companies, which has increased the opportunities for Indian startups to set their mark in their respective segments. Video conferencing and short video apps are one of the few segments which has registered a high growth for Indian alternatives.

65. India was elected as non-permanent member of the UN Security Council for a two-year term after winning 184 votes in the 193-member General Assembly, thereby increasing the country’s standing in global trade and taxation policy debates.

66. Over the last five years, global tech giants like Facebook, Google, and Twitter have also bought Indian startups to expand their offerings or boost their already existing portfolio. For instance, Google acquired popular transportation app Where is my Train, Twitter acquired mobile marketing and analytics company ZipDial, and Facebook acquired Little Eye Labs.

67. With India’s digital growth, Indian startups have not only become the number one destination to expand the market but also to make investments. Besides acquisition, global tech giants ranging from Amazon to Microsoft have also been eyeing on Indian startups through investments, accelerator programmes and other mentorship programmes.

Hyperlocal Bubble, Atmanirbhar Bharat & More

68. India’s hyperlocal market is expected to have reached a value of INR 2,306 Cr by 2020. This time around, unlike the hyperlocal bubble of 2016, startups in the hyperlocal space are not only focussing on lowering delivery cost and increasing margins, but also not expanding recklessly. The hyperlocal wave is being led by Dunzo, Zomato, Swiggy, Flipkart and others in the current day-and-age, but the sector saw massive upheaval in 2016 with over 400 startups recorded and 100+ startups shutting shops, including PepperTap, TinyOwl and others.

69. A study by Bain & Company done in collaboration with online retail giant Flipkart suggests that India has nearly 100 Mn online shoppers. The number is expected to grow to 300 Mn – 350 Mn by 2025 with a GMV of $100 Bn. The report adds that these 200 Mn shoppers will majorly come from Tier II and beyond regions, noting the next phase of the ecommerce growth. The report added that Tier 2 and below markets already see three out of five online orders being shipped to them.

70. Further reiterating the Make In India initiative, PM Modi came up with Atmanirbhar Bharat vision to make India self-reliant as the economy is struggling due to the Covid-19 pandemic and the resultant restrictions. With self-reliance in mind, the Indian government is trying to boost more local solutions as opposed to non-Indian products and services. The ban on 106 Chinese apps has further pushed Indians to look for more Indian solutions.

71. While we are discussing the Atmanirbhar Bharat vision, it is important to note that the Make In India campaign has also had its role to play in boosting Indian economy and incentivising production in India. One of the biggest examples here is China-based Xiaomi, which claims that 99% of its smartphones are made in India. After the government banned its browser and community app, the company is now looking to develop its MIUI software in India as well.

The Make In India campaign catapulted India to the fastest growing smartphone market in the world, and helped it to surpass the US to become the second largest smartphone market in the world. With more and more electronics and parts being manufactured in India, India will get first access to these technologies as has been the case with China for over two decades. According to Datalabs by Inc42, manufacturing and industrial SaaS solutions as well as deeptech products and services will play a pivotal role in advancing the “Make In India” mission seeing as automation and digitisation are key to increasing the overall productivity in manufacturing.

72. One of the major indicators of digital transformation in India is the rise in the number of internet subscribers in India. From around 233 Mn in 2014, India today has over 504 Mn active internet users. Much of the credit for this goes to the launch of Reliance Jio, which completely changed the telecom and mobile internet game in 2016. As of July 2020, TRAI reported 676 Mn broadband subscribers in India, including both wireless and wireline connections. Further, India has over 1.14 Bn mobile subscribers, out of which 629 Mn are based in urban areas.

73. The government launched the GeM (Government-e-Marketplace) in August 2016 to facilitate online purchases of goods and services by all the central government departments and ministries. The initiative was also used to further boost the Make in Indian initiative.

74. As indicated by former finance minister, the late Arun Jaitley in his Union Budget 2018 speech, the Indian government’s think tank Niti Aayog has been working on a roadmap for National AI programme. The Indian National Program for AI will be geared towards developing new applications of artificial intelligence technologies such as machine learning, natural language processing and more. More recently, in May 2020, IT minister Ravi Shankar Prasad launched the one-stop digital platform for all artificial intelligence (AI)-related developments in India.

The portal, ai.gov.in, will facilitate the sharing of resources highlighting the depths and usage potential of AI. This would include information on startups, investment funds, resources, companies, education institutions and other resources related to AI in India. The portal will share documents, case studies and research reports, among other useful study material. It will also host a section for online learning and skill development as well as new jobs in the AI segment.

With inputs from Kritti Bhalla and Nikhil Subramaniam

The post #StartupIndia: 74 Defining Moments From India’s Startup Ecosystem In The Last 5 Years appeared first on Inc42 Media.

![Movers And Shakers Of The Week [August 10 - 15]](http://inc42.com/wp-content/uploads/2020/08/Feature_Image_Movers-1.jpg)

![Funding Galore: Indian Startup Funding Of The Week [August 10- 15]](http://inc42.com/wp-content/uploads/2020/08/Feature_Image_Funding.jpg)

![Funding Galore: Indian Startup Funding Of The Week [August 10- 15]](http://inc42.com/wp-content/uploads/2020/08/Untitled-design-2020-08-15T194006.258.jpg)